Core Points

Auto Market: In April, the domestic automobile market’s sale was only about 1.18 million, which decreased 48% YoY.

New Energy Vehicle Companies: In April, domestic new energy vehicle companies were under pressure, and the resumption of work and production was in progress.

Annual Outlook: The short and medium-term market trends depend on the pace of resumption of work and production and the degree of control over supply chain resources by car companies.

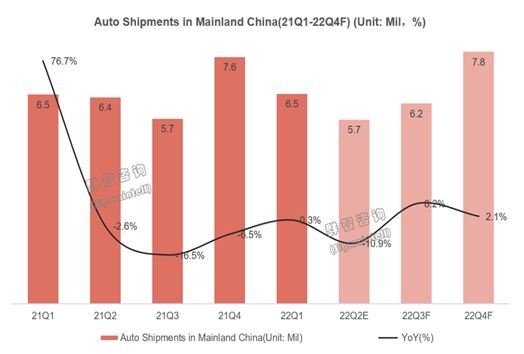

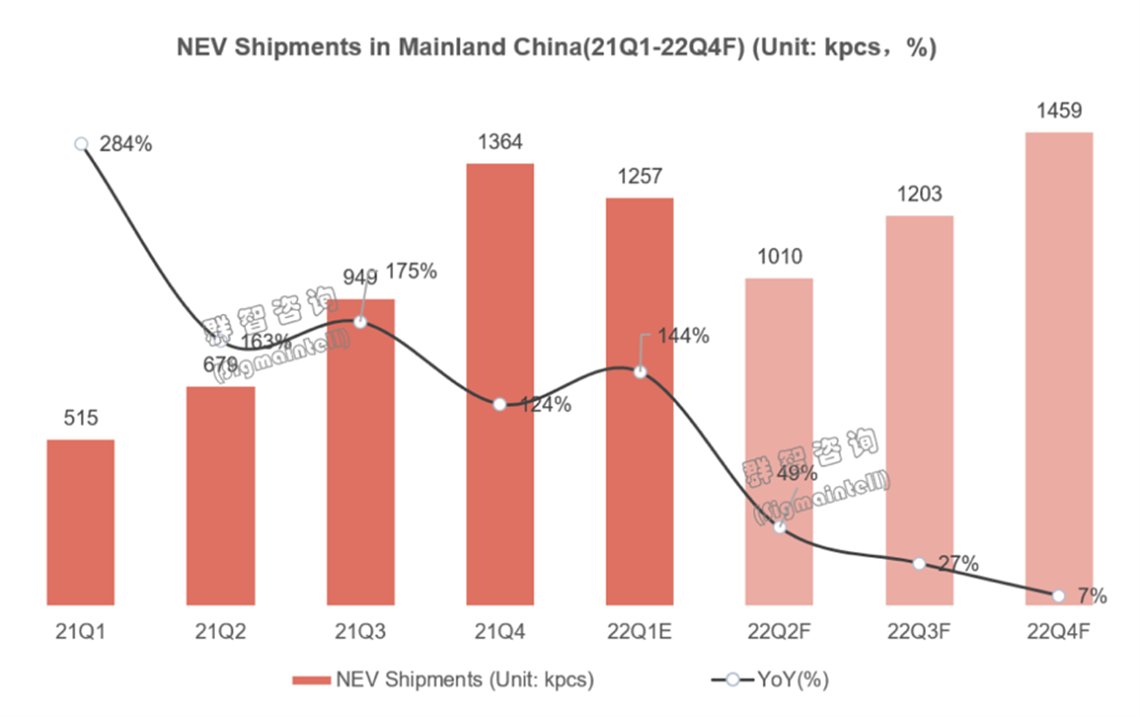

The past 2021 can be regarded as the first year for new energy vehicles’ developments, and 2022 is the most crucial step on the road to realizing the intelligentization of automobiles in the post-epidemic era. However, affected by the recent domestic epidemic, the development speed of cars has slowed down in the short term. Factors such as fabrication shutdowns and logistics blockages have plagued the upstream and downstream of the automotive supply chain. The most intuitive impact is reflected in production and sales data. Sigmaintell predicts that domestic auto sales will be challenging to grow this year, basically the same as last year's 26.2 million sales figures.

Data source: China Automobile Association, Sigmaintell

Auto Market: The domestic auto market sales in April were only about 1.18 million, which decreased by 48% YoY

In the first quarter of 2022, the cumulative domestic car sales were about 6.5 million units, basically the same as the data in the same period last year. Since the epidemic appeared in many places in March, the surrounding areas, mainly Jilin and Shanghai, have gradually entered a state of silent management under epidemic prevention and control, and automobile production and sales have faced an impact. According to data from the China Automobile Association, domestic car sales (including fuel and electric) in April were only 1.18 million, which decreased nearly 48% YoY, the first negative growth in the past six months. From the upstream of the supply chain, the chip shortage has not been significantly alleviated, especially with the rapid rise in the price of raw materials for power batteries, which further increases the cost of automobile manufacturing. From the downstream consumer side of automobiles, the rapid rise in crude oil prices has put pressure on the sales of fuel vehicles, which has also pushed some consumers to prefer new energy types. However, consumers are slightly less motivated to buy cars due to the current economic situation. Compared with the same period, it showed an inevitable decline, and the end market situation was not up to expectations.

Sigmaintell predicts that the supply troubles of auto components in April will still be reflected in the middle and late Q2. Although the inventory of auto parts has hedged against the impact in April, production in May-June still needs the support of the resumption of work. It is optimistically expected that the Yangtze River Delta region will resume work to full production in the middle and late May and is expected to recover the capacity lost in the early stage of the second quarter in June.

New energy vehicle companies: domestic new energy vehicle companies are under pressure in April, and the resumption of work and production is in progress.

Affected by the continuation of the recent epidemic, the new energy vehicle industry is under pressure on multiple links, such as the supply side, the production side, and logistics and transportation. Both the production and delivery processes are affected, and the delivery performance has declined to a certain extent. According to data from the China Automobile Association, domestic new energy sales in April were only 299,000 units, decreased by 38% MoM but still increased 45% YoY. As the epidemic gradually eased, most car companies resumed work and production in late April, and production capacity gradually increased.

From the perspective of each maker, the specific performance is as follows:

BYD

BYD's sales in April were about 106,000 units, an MoM increase of 1.1%. The April deliveries of brands such as " NIO-Xiaopeng-Li-Neta " collectively fell below five digits, showing negative MoM growths, in sharp contrast to BYD. The main reason is that the epidemic has not significantly affected BYD’s bases in Shenzhen, Xi'an, Changsha, Changzhou, etc. Factories can maintain a normal production rhythm under closed-loop management; combined with the vertical supply chain system represented by Fudi and BYD Semiconductor, the core components such as powertrain, battery, chassis, and interior and exterior trim parts realize the self-produced and self-supplied, significantly highlight the advantage of ensuring supply. Less affected by supply chain fluctuations and the market attention raised by the recent high-profile announcement that the production of fuel vehicles will be stopped, the sales will undoubtedly increase. BYD's seals, sea lions, seals, and other models based on the new platform will be gradually launched in the third quarter of this year, and this rich marine series will also provide consumers with more choices. In addition, as Fuzhou, Hefei, Zhengzhou, Jinan, and other bases have been put into operation gradually, we are optimistic about the target that the sales of new energy vehicles will hit 1.5 million units this year.

NIO

Affected by the epidemic since March, NIO's supply chain partners in Jilin and Suzhou-Shanghai areas have stopped production gradually, resulting in the suspension of its vehicle production for nearly half a month. Only 5,074 units were delivered in April, a YoY decrease of about 29% and an MoM decrease of 49%. NIO has put the Hefei and Jianghuai factories into trial production, and both are in the Yangtze River region. In the past, a stable supply chain during the non-epidemic period could maximize the efficiency of automobile production and reduce logistics costs. However, if there is control within the same region, continuous Production delivery risks are high. On the other hand, its primary model "866" sale is the first-generation platform product, and its intelligent configuration shows a specific backward trend. In addition, the ET7 model delivered in March this year is also difficult to sell due to its high price. This is also one of the reasons for the recent failure to achieve a rapid rise in sales. The upcoming release of the new EC6, ES6, ES8, and the new five-seat SUV ES7 upgraded to the NT2.0 platform will be the key to the rebound in sales. In addition, the ET5 model planned to be delivered in Q3 will be one of the biggest highlights of NIO this year. If NIO wants to return to the past glory, the new model must be entrusted with an important task.

Xiaopeng

Xiaopeng Motors delivered 9,002 units in April, which decreased by 42% MoM and 75% YoY. Compared with NIO and Li Auto, the main production sites of Xiaopeng are Zhaoqing's factory and Zhengzhou Haima foundry factory. The epidemic situation in the two places is relatively stable and has not affected vehicle production. Therefore, the delivery volume is less affected. In April, Xiaopeng became the only new car company that maintained a YoY sales growth between "NIO-Xiaopeng-Li.” New models also meet an increase, Xiaopeng G9 is expected to be delivered on a large scale in the third quarter of this year, and sales of all models are expected to hit the 300,000 during the year. Xiaopeng also plans to launch two new XPilot 4.0 models in 2023, which will also become a unique sales growth point in the future. The new platform technology will be on par with Tesla and Volvo, and its competitiveness in cost control will be further improved. In addition, the XPilot 4.0 platform, which also covers urban and high-speed NGP, together with supercharging technology, overseas markets, and Robotaxi, will become a new growth point for Xiaopeng Motors' business in the future.

Li

Li Auto delivered 4,167 units in April, which decreased by 25% YoY and 62% MoM, setting a new low point for deliveries this year. Li Auto's main production base is in Changzhou Jiangsu, and more than 80% of its parts partners are in the Yangtze River Delta region. Affected by the epidemic control and logistics in the Yangtze River Delta, some suppliers in Shanghai and Kunshan were unable to supply, resulting in the inability to maintain production after the existing components ran out. In April, the production of new cars was also frustrated, and the delivery of some orders was forced to be delayed. The extended-range SUV L9 that Li Auto will release shortly is a powerful supplement to its product line, and the annual sales volume is expected to reach more than 150,000.

Leapmotor

In April, Leapmotor successfully ranked first in the sales volume of new car manufacturers, with an MoM decline of only 10%, far lower than that of its peers. The sales volume of 9,087 vehicles has increased by more than 200% YoY for more than 12 consecutive months. Despite the YoY sale having a slight decrease because of the epidemic in the large environment, the impact of the epidemic’s effect on the supply chain has been effectively reduced due to the multi-enterprise supply and multi-regional planning methods applied in the supply chain. The Leapmotor C01, the world's first electric vehicle without an independent battery pack equipped with Leapmotor CTC technology, will be launched shortly for pre-sale and significantly improve the vehicle’s safety, performance, and battery life. The new products will further enrich the Leapmotor and helps to impact the market share in the high-end field.

Neta

Neta Auto's sales in April reached 8,813 units, a YoY increase of 120% and an MoM decrease of 26.72%. It has established a firm foothold in the new power camp of leading car manufacturers and has ranked among the top three in sales among new power brands for three consecutive months. Neta Auto has recently improved its product matrix and launched the new Neta U and Neta V in April, which set the tone for Neta’s contrarian growth. In addition, as the first model of the “Shanhai Platform,” The Neta S will also be available soon. As rising stars of the new domestic car-making forces, Neta and Leapmotor have similar development curves. Their main models benefit from the market popularity trend of A00-class spreading to A0-class. The counterattacks of Neta Auto and Leapmotor have brought about subversive changes in the competitive landscape of the new car-making forces, but whether they can be sustained remains to be tested by the market and consumers.

Annual Outlook: The market trend in the short and medium-term depends on the pace of resumption of work and production as well as the degree to which car companies control supply chain resources

According to the forecast of Sigmaintell, due to the epidemic’s impact, the domestic sales of new energy vehicles in 2022 are expected to decrease to about 4.9 million units. However, they would still increase by 40% YoY. From the quarterly aspect, sales in the second quarter had a relative decline compared to the first quarter due to supply chain shutdowns. With the continued progress of resumption of work and production, it is expected that the market will improve significantly in the third quarter, and the sales volume in the fourth quarter will still exceed that of last year.

Data source: China Automobile Association, Sigmaintell

Now that May has arrived, auto companies continue to resume work and production as the epidemic is gradually brought under control. The logistics, transportation, and supply chains are also recovering progressively. However, given the complex nature of the auto industry chain, the market trend in the short-medium term also depends on the pace of resumption of work and production, as well as the degree to which car companies control supply chain resources. Regaining market confidence on the consumer side is also a top priority. Judging from a series of discounts such as local governments issuing car purchase coupons and increasing car purchase indicators, promoting the purchasing power of rigid needs is the primary task. However, to increase consumers' willingness to buy a car, it is necessary to carry out financial promotion from multiple dimensions and release more policies that are beneficial to car purchase, such as reducing and extending the new energy vehicle purchase tax, offsetting personal income tax by purchasing cars, etc. Under the current situation, new energy vehicles are still the leader in driving the auto market’s recovery. Compared with the fuel car, besides the government’s favorable policies to promote carbon-free vehicles, new energy vehicles also have more advantages at the cost and consumers’ using experience.、

中文:

群智研究|疫情下汽车产业受挫,新能源仍是市场复苏最强动力

核心观点

汽车市场篇:4月份国内汽车市场销量仅约118万,同比下滑48%。

新能源车企篇:4月份国内新能源车企承压,复工复产进行时。

年度展望篇:中短期内市场走势取决于复工复产的节奏及车企对供应链资源的把控程度。

过去的2021年可以看做新能源汽车发展的元年,2022年则是汽车在后疫情时代实现智能化道路上最重要的一步,然而,受国内近期疫情影响,汽车的发展速度短期放缓,工厂停工、物流受阻等等事件困扰着汽车供应链上下游,最直观的影响体现在产销数据上,群智咨询(Sigmaintell)预测,今年国内汽车销量将难以增长,与去年的2620万辆销售数据基本持平。

汽车市场篇:4月份国内汽车市场销量仅约118万,同比下滑48%

2022年一季度,国内汽车累计销量约为650万台,与去年同期数据基本持平。自3月新冠疫情多地出现,以吉林和上海为主的周边地区陆续进入疫情防控下的静默管理状态,汽车产销面临冲击。根据中汽协数据,4月份国内汽车销量(含燃油+电动)仅118万,同比下滑近48%,为近半年以来首次呈现负增长。而从供应链上游来看,芯片短缺的问题仍未得到明显缓解,特别是动力电池原材料价格快速上涨,进一步拉升汽车制造成本,车企生产经营受挫而导致不约而同宣布涨价;从汽车下游消费端来看,原油价格的快速上涨致使燃油车型的销售面临着较大的压力,这也侧面推动了部分消费者更加倾向于新能源类型,但当前迫于经济形势,消费者购车动力略显不足,与同期相比呈现一定幅度下降,终端市场形势不及预期。

群智咨询(Sigmaintell)预测,4月份汽车零部件的供应困扰在Q2中下旬仍有体现,车企零部件库存虽对4月遭受的影响有所对冲,但5-6月份的生产仍需要各地复工的支持,乐观预计5月中下旬长三角地区复工至满产,有望在6月追回二季度前期损失的产能。

新能源车企篇:4月份国内新能源车企承压,复工复产进行时

受近期疫情延续影响,新能源汽车产业在供给端、生产端及物流运输等多个环节集体承压,在生产和交付过程均受影响,交付成绩出现一定程度的下滑。根据中汽协数据4月份国内新能源销量仅为29.9万台,环比下降达到38%,但较去年同期仍有45%涨幅。但随着疫情逐步缓解,大部分车企已在4月下旬陆续复工复产,产能逐渐开始爬坡。

各厂商来看,具体表现如下:

比亚迪(BYD)

比亚迪4月销量约10.6万台,环比仍逆势增长1.1%,而“蔚小理哪”等品牌的4月交付量集体跌破五位数,环比均呈现负增长,与比亚迪形成鲜明反差。其中主要源于比亚迪深圳、西安、长沙、常州等基地所在地区未受到疫情较大冲击,工厂在闭环管理下能保持正常的生产节奏,加上以弗迪系和比亚迪半导体为代表的的垂直供应链体系,动力总成、电池、底盘、内外饰件等核心零部件实现自产自供,最大限度保证供给的优势凸显,受供应链波动影响较小,且由于近期高调宣布停产燃油汽车消息引起的市场关注度,销量必然有所增长。基于新平台打造的比亚迪海豹、海狮、海鸥等车型将在今年三季度内逐步推出,海洋系列丰富的产品也将给消费者提供更多选择;此外随着抚州、合肥、郑州、济南等基地陆续投产,看好年内冲击150万台新能源车销量。

蔚来汽车(NIO)

自3月份以来受疫情影响,蔚来汽车位于吉林以及苏沪地区的供应链合作伙伴陆续停产,导致其整车生产停摆近半月,4月份仅交付5074台,同比下滑约29%,环比下降49%。蔚来目前已投入试产的合肥工厂以及江淮工厂同属长三角地带,在过去非疫情期间稳定的供应链可以最大限度提高汽车生产效率,并降低物流成本,但若出现同一地区内的管控,持续生产交付风险较大。另一方面其在售的主要车型“866”均为第一代平台产品,智能化配置呈现出一定的落后趋势,加上今年3月开始交付的ET7车型也由于售价较高难以走量,这也是近期销量未能实现快速上升的因素之一。即将发布升级到NT2.0平台的新款EC6、ES6、ES8以及全新五座SUV ES7,将会是销量反弹的关键,此外,计划Q3交付的ET5车型将是蔚来今年最大看点之一,蔚来欲重返昔日光辉,新车型必将委以重任。

小鹏汽车(Xiaopeng)

小鹏汽车4月交付9002台,环比下滑42%,同比增长75%。相比蔚来和理想,小鹏汽车的主要生产地为肇庆自有工厂及郑州海马代工厂,两地疫情较为平稳并未影响到整车生产,因此交付量受影响较小,小鹏也成为4月份“蔚小理”中唯一一家保持销量同比增长的新势力车企。在新车型方面也继续发力,小鹏G9预计将于今年Q3大规模交付,年内全车型销量有望冲击30万大关。并且其计划在2023年将推出的两款全新平台XPilot 4.0车型,也将会成为未来新的销量增长点,该全新平台技术上看齐Tesla和Volvo,在成本控制上的竞争力进一步得到提升,此外同时覆盖城市和高速 NGP的XPilot 4.0平台也将和超充技术、海外市场和 Robotaxi 在未来成为小鹏汽车业务新的增长点。

理想汽车(Li)

理想汽车4月共交付4167台,同比下滑25%,环比下降达62%,刷新今年以来交付量新低。理想汽车主要生产基地位于江苏常州,同时超过80%的零部件合作伙伴位于长三角地区。受长三角疫情管控及物流影响,上海和昆山地区的部分供应商无法供货,导致现有零部件库存消化后无法继续维持生产,4月份的新车生产也因此受挫,部分订单交付被迫延期。理想汽车在近期即将发布的增程式SUVL9,是对其产品线的一有力补充,全年销量有望达15万以上。

零跑汽车(Leapmotor)

4月份零跑汽车成功跻身造车新势力销量首位,环比下滑幅度仅10%远低于同行,以9087辆的销量连续12个月以上同比增长超过200%。尽管处于大环境下饱受疫情困扰而造成环比微降,但因其在供应链上采取多企业供应和多区域规划的方式,有效降低了疫情对供应链的冲击力度。搭载零跑CTC技术的全球首款无独立电池包电动车零跑C01也将于近期正式开启预售,在汽车安全、性能、续航等方面将会有较大提升,新产品将进一步丰富零跑产品矩阵,助力冲击高端领域市场份额。

哪吒汽车(Neta)

哪吒汽车4月销量达8813辆,同比增长120%,环比下跌26.72%, 其已基本在头部造车新势力阵营站稳脚跟,已连续三月在新势力品牌中销量排名前三,并且哪吒汽车近期持续完善产品矩阵,在4月份推出了新款哪吒U和哪吒V,两款新车型的推出为哪吒汽车的逆势增长奠定了基调,此外作为“山海平台”首款车型的哪吒S也即将上市。作为国内造车新势力的后起之秀,哪吒与零跑的发展曲线较为相似,其主销车型受益于A00级市场热度向A0级扩散的趋势。哪吒汽车与零跑汽车的逆袭让造车新势力的竞争格局发生了颠覆性的变化,但能否持续还有待市场和消费者的考验。

年度展望篇:中短期内市场走势取决于复工复产的节奏及车企对供应链资源的把控程度

根据群智咨询(Sigmaintell)预测,受疫情影响,国内新能源汽车2022年全年销量预计将减少至约490万辆,但同比去年仍增长40%。分季度来看,二季度因供应链停产问题销量较一季度下滑,随着复工复产持续推进,预计三季度开始市场明显好转,四季度销量仍将超过去年水平。

如今5月已至,随着疫情逐步得到控制,汽车企业持续复工复产,物流运输和供应链也逐步恢复,但鉴于汽车产业链的复杂性质,中短期内市场走势取决于复工复产的节奏及车企对供应链资源的把控程度。在消费端重拾市场信心也是重中之重,从各级地方政府发放购车抵用券、增加购车指标等一系列优惠来看,推动刚需购买力是首要任务。但要让消费者购车意愿增加,还需从多维度进行经济推动以及释放更多利好汽车消费的政策,如新能源购置税减免延期、购车抵个人所得税等。当前形势下,新能源依然是拉动车市复苏的领军者,在政府推动无碳化释放的政策利好之外,在消费者用车的成本及体验方面,新能源汽车相对级燃油车的优势也愈发明显。