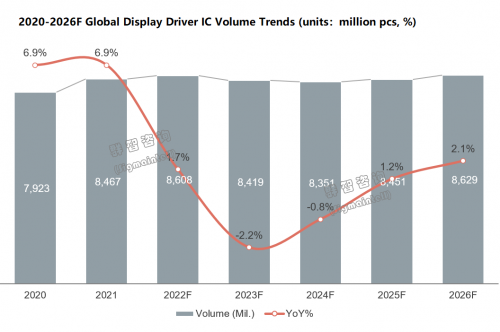

With the continuous development of emerging technologies such as AI, 5G, and semiconductors, human society has developed from the computer era to the mobile Internet era. "Display" has become popular and the most important thing for people. One of the interactive methods. The display industry at home and abroad has obtained unprecedented development opportunities, driving the continued prosperity of upstream display driver IC and other industries. Due to home consumption blooming, like home working, home education etc., set makers had a stronger requests for display makers to ship them. According to Sigmaintell data, global driver IC shipped around 8.5 billion, YOY increasing around 6.9%.

With the early consumption of display terminal devices due to the epidemic, and the slowdown in the global economic recovery, it shows that the growth momentum of display demand is insufficient. In addition, global wafer capacity expansion is aggressively, and the overall supply and demand will be balanced in 2022. However, in 2021, the DDIC industry experienced various black swan events, and in early 2022, the outbreak of the Russian-Ukrainian conflict may have an impact on the semiconductor supply chain. Stable supply has become the primary consideration in the industry. As a result, even though overall demand has fallen DDIC inventory levels have continued to rise. According to Sigmaintell data, the volume of global DDIC are expected to reach 8.6 billion units in 2022, an increase of 1.7% YoY. Considering the demand early broken and the integration trend of DDIC, it will be a negative demand of 2023, be possible around - 2.2% growth by volume.

Due to IC shortage and promising demand for cloud computing, AI, EV, 5G and IoT related applications, with order visibility extended to 2025, pure-play foundries have accelerated their capacity expansions in 2022. At present, 8-inch foundries are approaching full load, and it is estimated that the tight production capacity will not ease in the short term. Due to the equipment maker has stopped producing 8-inch equipment, it is difficult to expand production. 12-inch wafer capacity will continue to release, with the largest increase in 2023. According to Sigmaintell data, main foundries capacity is expected to increase by about 15% YoY in 2023. Among them, capacity expansion of DDIC is mainly concentrated in 12-inch, and the capacity is expected to increase by about 21% YoY in 2022. As the proportion of OLED in display continues to increase, and the shortage of OLED DDIC capacity, the expansion is also mainly concentrated on 28/40nm process.

In 2022, the price of display driver ICs has started to decline, but the prices of raw materials such as silicon raw wafers are still rising, and the cost of wafer manufacturing remains high. In the face of weak demand in the display market, panel makers cannot afford to drive IC prices up, and Fabless will be difficult to maintain high product gross profit margins. Under the squeeze, how will Fabless adjust, and how will product and customer strategies change? Will the competitive landscape of the display driver IC market change? How will fab capacity be allocated? How will the supply chain relationship between the panel makers, Fabless, wafer foundries? What is the development status of the domestic display driver IC supply chain in mainland China? How will the supply and demand of display driver ICs change? What will be the price trend of display driver IC?

......

For more details, please pay attention to Sigmaintell "Global Display Driver IC Industry Trend Research Report (2021-2026)".

Contents:

Macro Environment

DDIC Market Trend (2021-2026F)

DDIC Market Trend Summary

Global Display Driver IC Volume / Revenue Trends

Global Display Driver IC Shipment Volume / Revenue by Tech. (OLED/LCD)

Global Display Driver IC Shipment Volume / Revenue by Types (DDI/TDDI)

Global Display Driver IC Shipment by Application 2021-2026F (TV/IT/Mobile…)

Global Display Driver IC Shipment by Application 21Q1-22Q4F (TV/IT/Mobile…)

Wafer Supply Trend (2019-2024F)

Wafer Supply Trend Summary

Global Main Foundry Wafer Expansion Plan 2019-2024F

Global Main Foundry 28/40nm Expansion Plan 2020-2024F

Wafer Expansion Plan of TSMC

Wafer Expansion Plan of UMC

Wafer Expansion Plan of Global Foundries

Wafer Expansion Plan of SMIC

Wafer Expansion Plan of PSMC

Wafer Expansion Plan of VIS

Wafer Expansion Plan of Huahong Group

Wafer Expansion Plan of Nexchip

Global Foundries DDIC Wafer Expansion Plan

DDIC Supply Chain

DDIC Supply Chain Summary

Supply Chain Mapping

Global Fabless DDIC Supply Trend by Application 2021-2022F

DDIC Supply Chain of Samsung LSI

DDIC Supply Chain of Novatek

DDIC Supply Chain of Himax

DDIC Supply Chain of Magnachip

DDIC Supply Chain of Focaltech

DDIC Supply Chain of Raydium

DDIC Supply Chain of Fitipower

DDIC Supply Chain of Siliconworks (LX Semicon)

DDIC Supply Chain of Sitronix

DDIC Supply Chain of Chipone

DDIC Supply Chain of Eswin

DDIC Supply Chain of Omnivision

DDIC Supply Chain of Galaxycore

DDIC Supply Chain of SDmicro

China Mainland OLED DDIC Supply Chain 2022F

DDIC Supply & Demand (2019-2024F)

Global DDIC Supply and Demand Trends

Global OLED DDIC Supply and Demand Trends

Global Foundry Wafer Price Trends

Global DDIC Price Trends (Smartphone/TV/IT)

DDIC Technology Trend

DDIC Technology Roadmap

TDDI Develop Trends

OLED TDDI Develop Trends

FTDDI Develop Trends

Summary

提交右侧信息,了解更多会员服务方案;

或直接联系我们:

+86 151-0168-2530

抱歉,暂无样报