The bell has already sounded at the end of 2022, and entering 2023, looking back at the decades-long changes in the Chinese TV market, after several ups and downs and entering the stock competition, the market reform has come in a critical node.

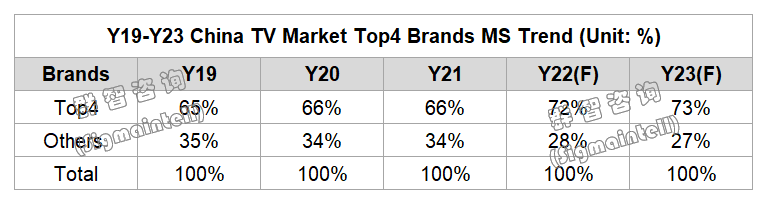

Brand barriers are high, and CR4 exceeds 70%

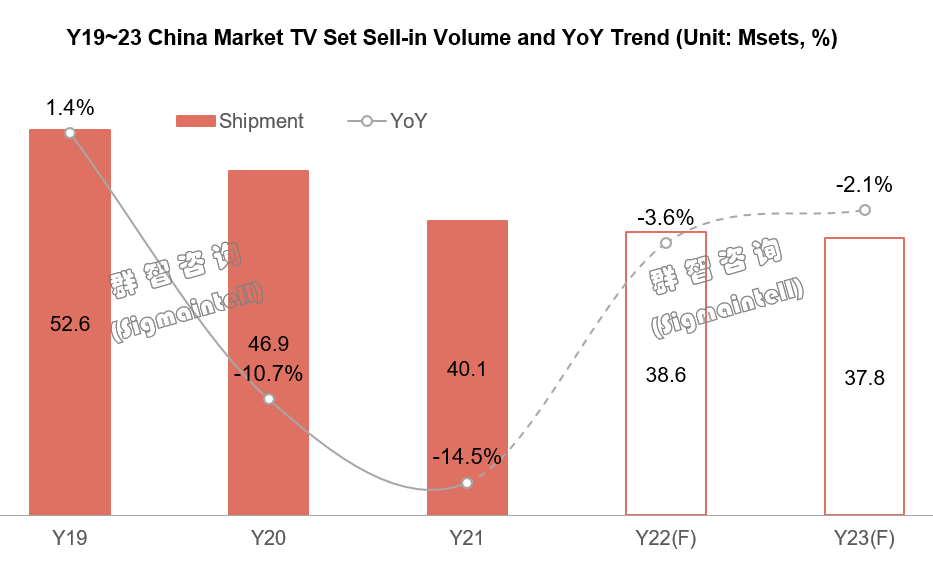

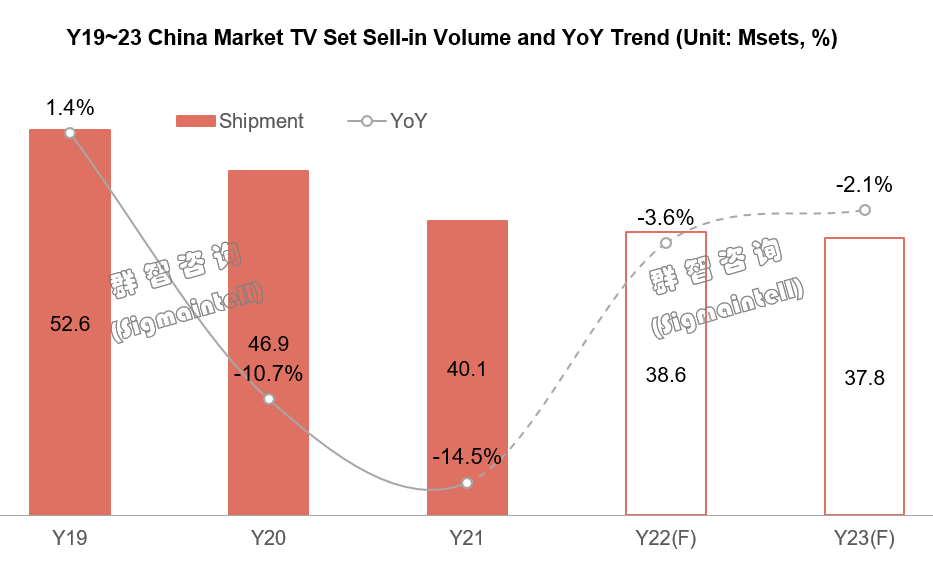

After three years of the epidemic’s impact, superimposing by the high energy consumption caused by overseas imported inflation swallowed and weakened the public's consumption power. Considering the uncertainty of the future, consumers' sense of anxiety has increased, and their consumption concepts have turned rational and conservative. TV, as a not rigid demand product, its demand continued to weaken. According to Sigmaintell research data, China’s TV market shipments are expected to continue to fall to 38.6 Msets in 2022, a YoY decrease of 3.6%. The market size will remain low in 2023, and it is difficult to expect a strong recovery in demand in the short term.

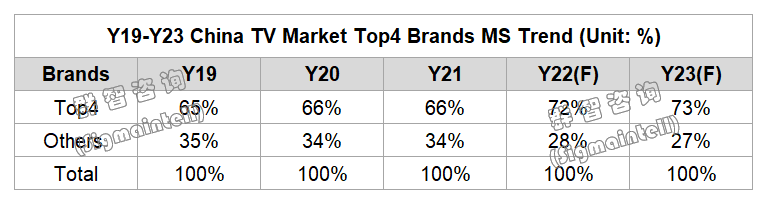

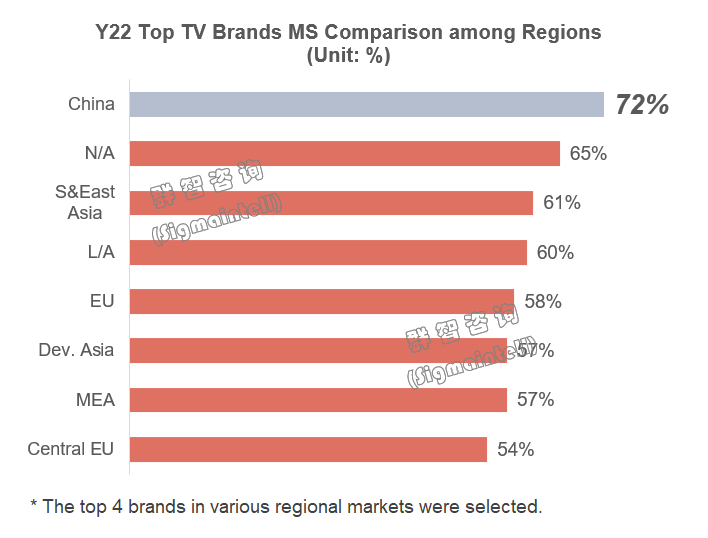

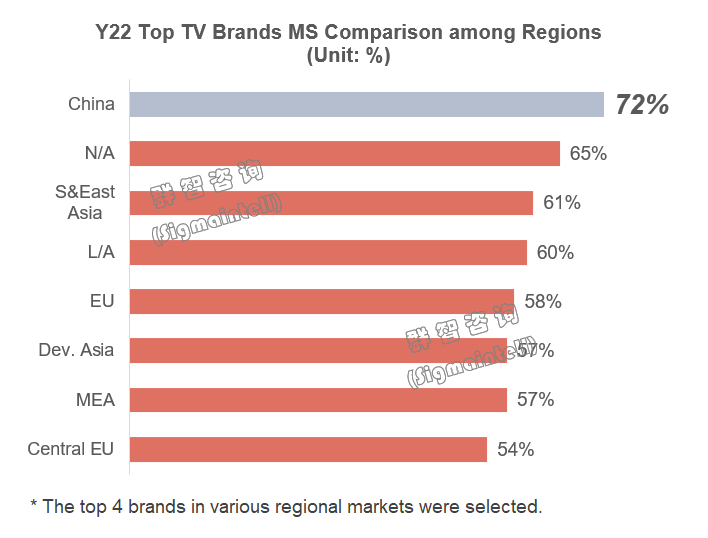

In the stock(limited) market, consumer iterative demand dominates the mainstream. Differentiated and high-quality products and satisfying consumers' consumption needs that keep pace with the times have become an eternal topic of market and brand discussion. It also puts forward higher requirements for brand product understanding, development, manufacturing, and supply chain support. According to Sigmaintell’s research data, the concentration of brands in the Chinese market will increase significantly in 2022, and the market share of Top4 brands, including Hisense, TCL, MI, and Skyworth, will reach 72%, far exceeding other regional markets. Given the current situation, looking back at the performance of the market and mainstream brands throughout the year, Sigmaintell believes that the following changes are worthy of attention:

Market demand - the overall market is sluggish, but high refresh rate and large-size products are favored.

Market demand - the overall market is sluggish, but high refresh rate and large-size products are favored.

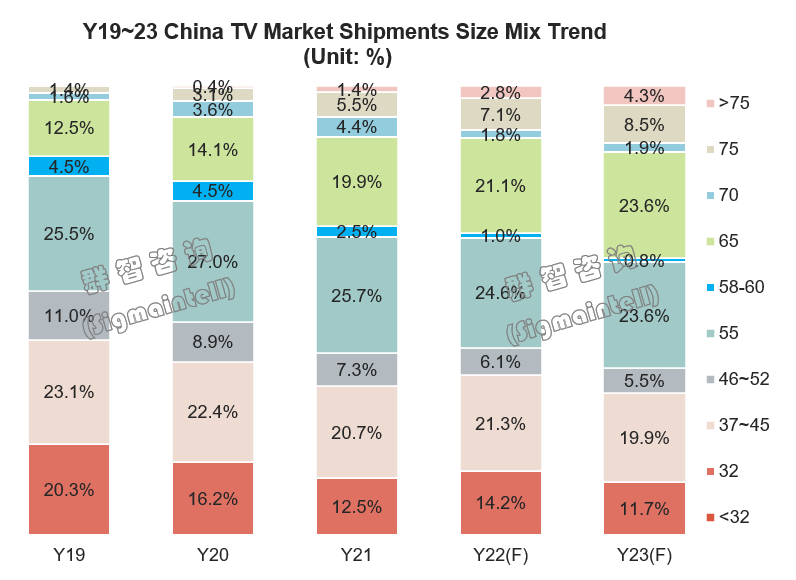

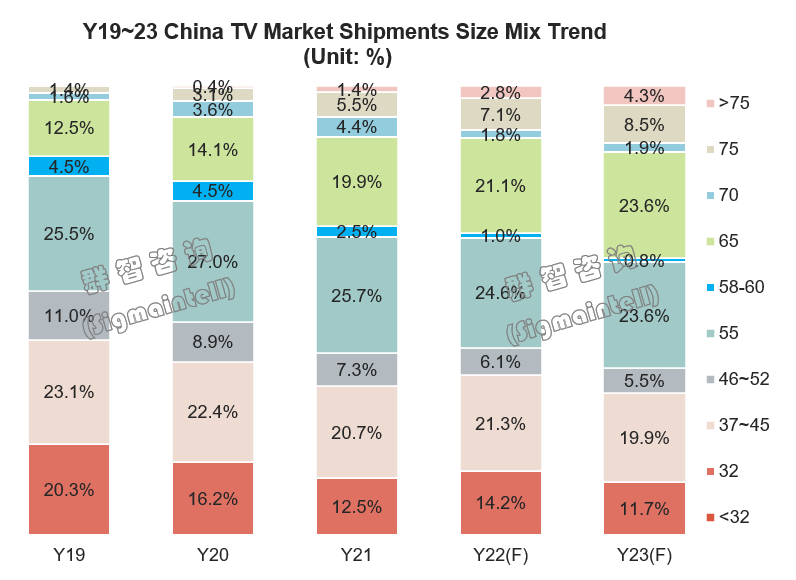

The demand for the Chinese TV market remains at a low level of less than 40 Msets, but there are still opportunities from the perspective of product structure changes. Low-price promotions have not stimulated the demand for low-end products. On the contrary, the demand for mid-range products of 65” and above have good news; the upgrading trend of the size structure is obvious, especially in the high refresh rate market. The reduction in end promotion prices brought about by the overall cost reduction of TVs has positively promoted the active expansion of the large-size, high refresh rate product market, which is in line with the consumption tendency of the main young consumer groups and the characteristics -- high popularity of large size in the Chinese market.

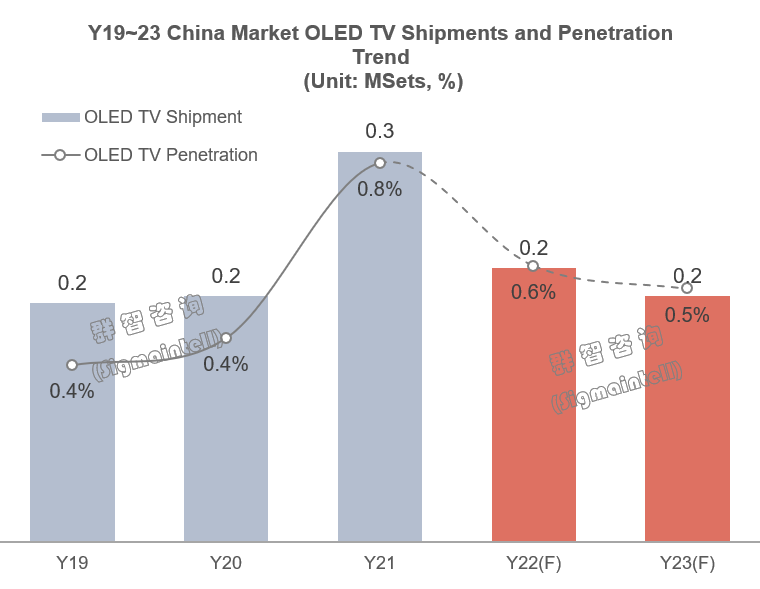

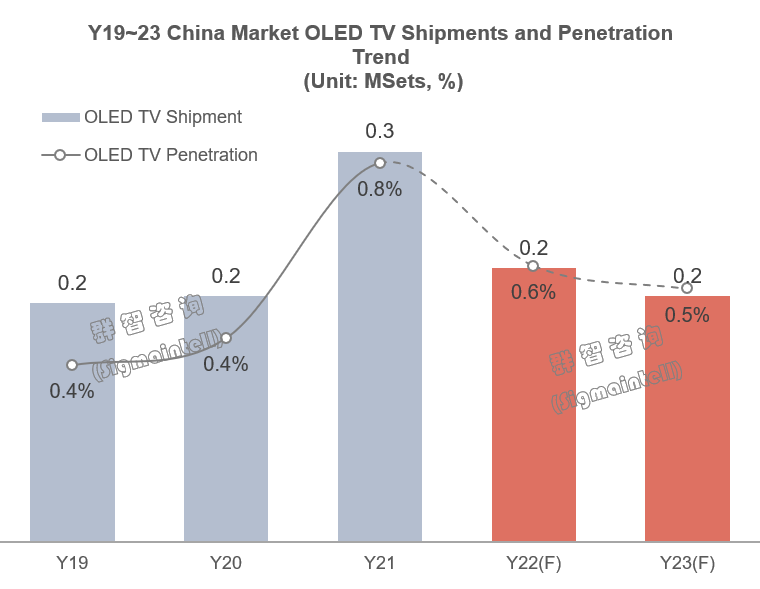

However, it is worth noting that this promotional bonus is not reflected in high-end products. The demand for high-end TV products, including OLED and 8K, continues to shrink, which shows that the reach of consumer demand is still limited.

Brand strategy - multi-brand operation to promote incremental profit.

Brand strategy - multi-brand operation to promote incremental profit.

To stabilize the brand market share and strengthen the brand label, the multi-brand operation strategy has become a competitive weapon. We can see that Hisense, TCL, MI, etc., are all developing their sub-brands, clarifying the positioning of sub-brands, and forming a development strategy of high-end and low-end collocation with the main brand in the product line layout. Focus on the low-end market and the young Z-generation consumer group, pay attention to game TV, music TV, and other market segments that meet the needs of young people, rely on the product development and manufacturing capabilities of the main brand, create a fresh brand label, and rapidly expand the market scale, to reach the top of demand. At present, in terms of market share, the Vidda brand is firmly in tier 1 of sub-brands due to its clear product positioning, with the help of Hisense's development and manufacturing capabilities and channel resources. Redmi was squeezed by the traditional brand strategy, and the market performance was not as good as expected. The gap between the two continued to narrow, and they both belonged to tier 2. But in any case, thanks to the market operation of sub-brands, the cost of the supply chain, and the advantages of R&D and manufacturing, they jointly build up the market barriers of main brands, and other brands are hard to come by. The highly concentrated market structure has both advantages and disadvantages. Without the contention of a hundred schools of thought, the innovation of products and usage scenarios is deeply bound to the main brands to a certain extent, and there is a risk of declining vitality.

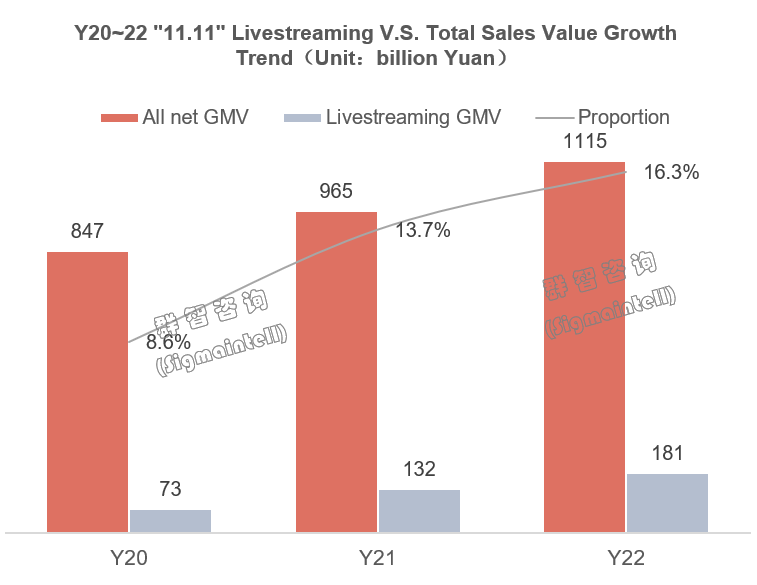

Channel Change - online/offline channel dual-track driving online – the traditional online platform is up to peaks, and social e-commerce has become a new demand growth point.

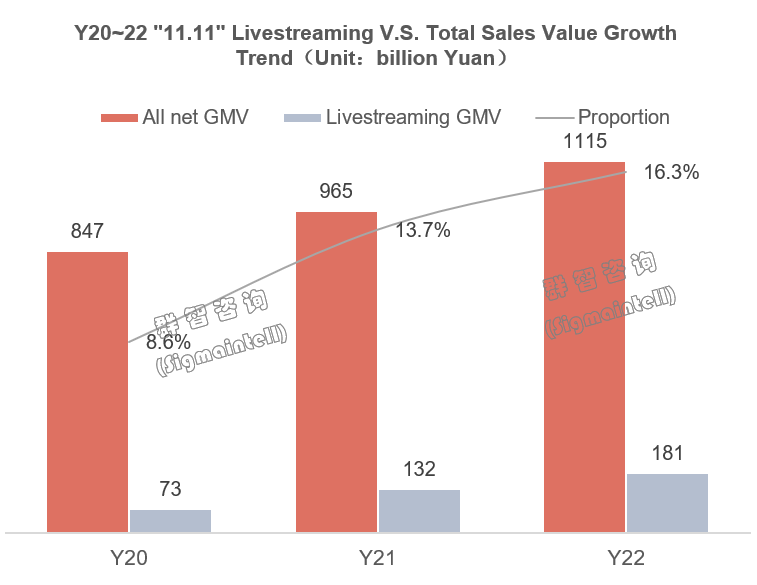

Affected by changes in consumer shopping behavior and the continuous impact of the epidemic on offline entities, the proportion of online channels in the Chinese TV market has maintained high growth. By 2022, the proportion of online channels will still exceed 70%. However, in 2022, the potential demand of traditional online platforms was up to peaks, live broadcast e-commerce and social e-commerce rose rapidly, and the "social recommending" scenario linked to traffic accounts will have a high conversion sales model, which will attract more traffic attention and become the brand's online sales channel expansion and become the new darling of brand online sales channel expansion.

Offline-Traditional channels are weakening, and brands are increasing their self-operated offline stores.

Offline-Traditional channels are weakening, and brands are increasing their self-operated offline stores.

Due to the epidemic's impact on offline consumption habits, traditional household appliances stores such as Gome and Suning have faced difficulties in their operations. They may gradually fade out of the historical stage. On the other hand, China's mainstream brands are actively deploying self-operated offline stores, implementing offline experience and online consumption, and improving consumers' sense of experience and consumption stickiness. Among them, tier 1 and tier 2 cities pay more attention to large shopping malls, relying on the product layout of the brand's entire ecological chain to create a scenario-based sales model. Tier 3 and tier 4 cities sink to counties and towns to find incremental opportunities. At present, Hisense has adopted the "one city, one store" strategy offline, and the scenario-based marketing model has driven the demand for high-end products. Xiaomi Home has expanded its offline stores to 10,000, with a full ecological chain product display, stabilizing its market share in China. It is believed that as the epidemic’s impact gradually weakens, offline consumption will eventually recover in an orderly manner, and the share of leading brands is expected to increase further.

Profit Change – The Internet profit model is a double-edged sword.

With the rapid development of the Internet in China and Internet companies joining the competition in the TV industry, the proportion of brand OTT value-added service revenue (including membership revenue, vertical service revenue, and advertising revenue) continues to increase. According to official statistics, up to 2021, Chinese OTT integrated service revenue will reach 7.8B yuan, with a YoY of nearly 10%. The development prospects are indeed worth expectancy. Major brands, including Hisense, TCL, Xiaomi, and Skyworth, also focus on this business segment and expand the end user base through hardware distribution. OTT value-added services to realize traffic conversion and realization. But it is worth noting that, on the one hand, excessive profit-making hardware will also fall into the swamp of price competition, which will adversely affect the healthy development of the industry. On the other hand, according to consumer evaluations of flat-panel TVs on e-commerce platforms, consumers are also increasingly negative about issues such as advertising broadcasts and incompatibility of membership fees. Therefore, how to ensure a better user experience for consumers and rationally optimize OTT service methods will become the key to maintaining the stable development of the brand. The Chinese TV market is sluggish and urgently needs reform and innovation. The main brand should bravely take up the banner of the industry. While the enterprise is operating stably, it has the courage to try and change product development, technology iteration, etc., breakthrough with "differentiated" technology, change the thinking mode, formulate a plan suitable for the development of the times, and meet the individual needs of consumers as much as possible. Only by breaking the vicious circle of "price wars" can the industry be put on the track of healthy development.

Sigmaintell believes that:

(1) Brands should maintain innovative vitality, listen to consumers' real product demands, and provide products that better meet the individual needs of consumers. At present, the large size of the Chinese market does not mean that the product is "high-end.” In the face of consumers' demand for personalized and smart TV products, efforts should be made to promote size upgrades, technology iterations, and scenario application exploring. Only excellent product quality can truly be recognized by consumers.

(2) In the changing environment, mainstream brands need to maintain "strategic determination" and "robust" operation and formulate strategies that match the brand's own resources and goals on the basis of fully studying the changing trends of core elements such as users, market environment, and supply chain direction, and continue to implement it steadily.

(3) Optimize Internet value-added services, explore and expand software profit space and development potential, take into account consumer experience, and strive to achieve a combination of software and hardware for coordinated development.

中文:

中国电视市场“需,策,道,利”攻防一体

2022年末钟声已经敲响,步入2023年,回顾中国电视市场数十年变迁,几经起伏,并步入了存量竞争,市场变革迎来关键节点。

品牌壁垒高企,Top4品牌市占率超70%

经历了疫情三年的冲击,叠加海外输入性通胀带来的能源性消费高企,吞噬和削弱大众消费力;对于未来的不确定性,消费者忧患意识加强,消费观念转向理性保守;电视非刚性耐耗消费品需求持续走弱。群智咨询(Sigmaintell)研究数据显示,预计2022年中国电视市场出货量将持续回落至3860万台,同比下降3.6%,2023年市场规模仍维持低位下探,短期难以期待需求强劲恢复。

存量市场,消费迭代需求占据主流,差异化且品质优异的好产品,满足消费者与时俱进的消费需求,成为市场和品牌讨论的永恒课题,也对品牌的产品理解、开发、制造、供应链配套提出了更高的要求。根据群智咨询(Sigmaintell)研究数据,2022年中国市场品牌集中度大幅提升,包括海信、TCL、MI和创维在内的Top4品牌市占率达到72%,远超其他区域市场。现状如斯,回顾全年市场和主流品牌表现,群智咨询(Sigmaintell)认为有如下变化值得关注:

市场需求-大盘萎靡,高刷大尺寸产品受青睐

中国电视市场大盘需求维持4000万台以下的低位水平,但从产品结构变化角度看依然存在机会,低端产品需求并没有受低价促销刺激而恢复,反而65”及以上中端产品需求增势喜人,尺寸结构升级趋势明显,尤其体现在高刷市场。电视整体成本下降带来的终端促销价格下调,正向推动了大尺寸、高刷产品市场的积极扩张,符合主力年轻消费群的消费倾向和大尺寸高热度的中国市场特点。

但值得注意的是,这种促销红利并没有体现在高端产品层面,包括OLED,8K在内的高端电视产品需求持续收缩,可见消费需求触达层面依旧受限。

品牌策略-多品牌运营,促成增量保利

为稳固品牌市场份额,强化品牌标签,多品牌运营策略成竞争利器。我们可以看到,海信、TCL、MI等均大力发展旗下子品牌,清晰子品牌定位,与主品牌在产品线布局上形成高低端搭配的发展策略。聚焦中低端市场和年轻Z世代消费群,关注贴合年轻人需求的游戏电视,音乐电视等细分市场,以主品牌的产品开发和制造能力为依托,打造鲜活品牌标签,迅速提升市场规模,抢占需求高地。目前从市场份额上看,Vidda品牌凭借清晰产品定位和海信的开发制造能力以及渠道资源投放,稳居子品牌第一梯队;雷鸟持续加强中低端产品布局,成长势头迅猛,红米受到传统品牌策略挤压,市场表现不及预期,二者之间差距持续缩小,同属第二梯队。但不论如何,得益于子品牌的市场运营,供应链成本和研发制造优势,共同筑高主力品牌市场壁垒,其他品牌难望其项背,这就促成中国市场从群雄逐鹿到三足鼎立的格局演化。高度集中的市场格局,有利有弊,没有了百家争鸣,产品和使用场景的推陈出新在一定程度上与主力品牌深度绑定,存在活力下降风险。

渠道变革-线上/线下渠道双轨驱动线上-传统线上平台流量见顶,社交电商成新流量密码

受消费者购物行为习惯的转变,叠加疫情对线下实体的持续冲击,中国电视市场线上渠道比重维持高增长,截止2022年线上比重依然超过70%。但2022年传统线上平台流量见顶,直播电商、社交电商迅速崛起,与流量账号联动的“种草”情景高转化销售模式,分得更多流量关注,成为品牌线上销售渠道拓展的新宠。

线下-传统渠道走弱,品牌加码自营线下门店

国美、苏宁等传统家电卖场受疫情对线下消费习惯影响,自身运营陆续遭受困境,恐将逐渐淡出历史舞台。而中国主流品牌转向积极布局自营线下门店,落实线下体验,线上消费,提升消费者的体验感和消费粘性。其中一线、二线城市更多关注大型购物卖场,凭借品牌全生态链产品布局,打造场景化销售模式;三四线城市下沉乡镇,寻找增量机会。目前海信通过线下“一城一店”策略布局,场景化营销模式带动高端产品需求增长;小米之家线下万店拓展,搭配全生态链产品陈列,稳定中国市场份额。相信伴随疫情影响逐步减弱,线下消费终将有序恢复,头部品牌的份额有望进一步提升。

盈利变化-互联网盈利模式是把双刃剑

互联网在中国的高速发展和互联网企业加入到电视行业竞争中,品牌OTT增值服务营收(包含会员收入、垂直服务收入、广告收入)占比持续增加。据官方统计数据显示,截至2021年,我国OTT集成服务收入达到78亿元,同比增速接近10%,发展前景确实值得期待,包括海信、TCL、小米、创维等主力品牌也重点布局该业务板块,通过硬件让利,扩大终端使用群,OTT增值服务实现流量转化和变现。但值得注意的是,一方面,过度让利硬件,同样会陷入价格竞争的泥潭,为行业健康发展带来不利影响,另一方面,从电商平台平板电视消费者评价了解,消费者对于广告播放,会员收费不兼容等问题也出现越来越多的负向情绪。因此,如何保证消费者较好的使用体验以及合理优化OTT服务方式将成为品牌维持稳健发展的关键。中国电视市场整体萎靡,亟待变革和创新。主力品牌应勇挑行业大旗,在企业稳健经营的同时,在产品开发,技术迭代等方面勇于尝试和变革,以“差异化”技术突破,改变思维模式,制定适合时代发展的方案,尽可能地去满足消费者个性化需求,打破“价格战”的恶性循环,才能将行业带入健康发展的轨道。

群智咨询(Sigmaintell)认为:

(1)品牌应保持创新活力,倾听消费者真实产品诉求,提供更加符合消费者个性化需求的产品。目前中国市场的大尺寸并不意味着产品“高端”化,面对消费者对电视产品个性化、智能化的需求,应努力推动尺寸升级与技术迭代、场景应用挖掘,过硬的产品品质才能真正得到消费者的认可。

(2)变革环境下主流品牌需保持“战略定力”和“稳健”经营,在充分研究用户、市场环境、供应链等核心要素变化趋势基础上,制定与品牌自身资源和目标相匹配的战略方向,并持续稳健的执行下去。

(3)优化互联网增值服务,挖掘和扩大软件盈利空间和发展潜能,兼顾消费者使用体验,争取实现软硬结合,协同发展。