Event background:

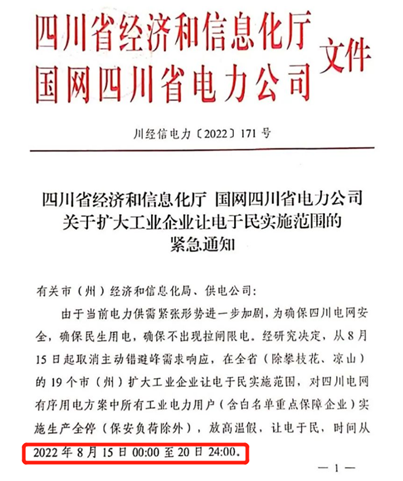

On August 15, a document called "Emergency Notice on Expanding the Scope of Industrial Enterprises to Give Power to the People" was jointly issued by the Sichuan Provincial Department of Economy and Information Technology and the State Grid Sichuan Electric Power Company. The government has decided to cancel the active staggered electricity demand response from August 15th as the current tension between power supply and demand has further intensified and to ensure Sichuan power grid safety and people's livelihood electricity and no power cut phenomenon. The policy implementation scope of industrial enterprises to give electricity to the people will be expanded in 19 cities (prefectures) in the province (except Panzhihua and Liangshan). All industrial power users (including white-listed key guarantee enterprises) in the orderly power consumption plan of Sichuan Power Grid will implement a full production shutdown (except for protective load), high-temperature holidays, and power to the people. The time starts from 00:00 on August 15th and ends at 24:00 on August 20th, 2022. All subordinates should immediately notify the enterprise to make production adjustments, ensure protective load, and quickly implement them in place.

Main conclusion:

The power cuts in Sichuan caused local display and consumer electronics makers to maintain low utilization rates for six days. At present, the inventory of the entire consumer electronics industry is higher than the normal level. As a major making center of consumer electronics, the low production utilization rate can also help the entire industry inventory liquidation and promote destocking faster.

Panel maker: The main production lines are controlled by power cuts in non-production areas, and the production lines of individual makers are suspended. However, due to the high inventory in the overall industry, the market is in a state of oversupply. So the power cuts will help the industrial chain to destock and alleviate the imbalance between supply and demand.

Material maker: Some material makers have halted production due to power cuts, and the shipment mainly relies on pre-inventory. Besides, panel makers also have a certain period of inventory, which has little impact on the operation of the enterprise.

ODM/OEMs: Most of the ODM/OEMs have halted production, and only 20% of the protective load is retained. The power cuts will affect the set production, especially the notebook PC.

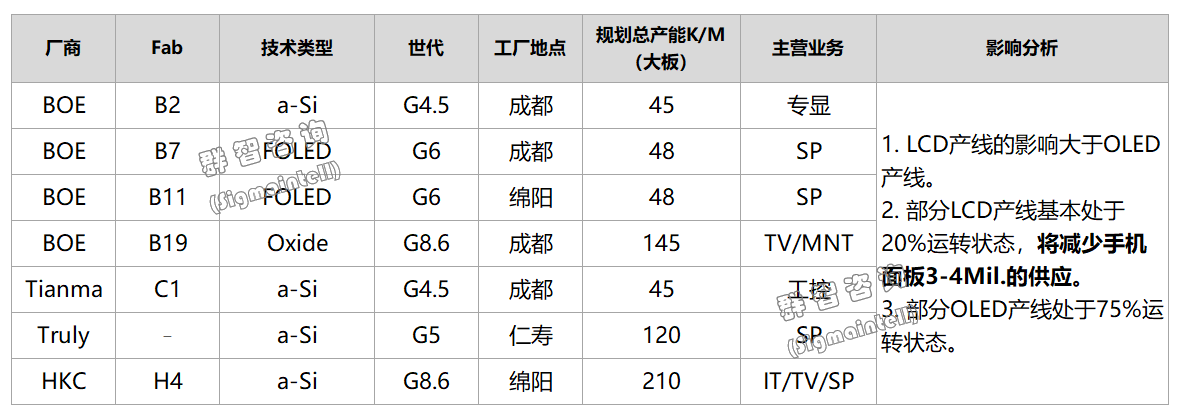

Smartphones: The supply of a-Si LCD panels are mainly affected, which will reduce the supply of 3-4Mil.pcs of smartphone panels, accounting for about 3-4% of the supply for the month.

Notebook PC: The notebook ODM/OEM capacity in Chengdu accounts for about 20% of China Mainland, mainly including Quanta, Compal, Foxconn, Wistron, and other major PC ODM/OEMs. Sigmaintell estimates that the impact on the shipments of various notebook PC brands is different, the order of impact is from high to low: Apple, Dell, Asus, HP, and Lenovo. It is necessary to pay attention to whether it will affect the panel stocking rhythm of PC brands.

According to Sigmaintell’s analysis, the power shortage in Sichuan is mainly due to the limitation of natural conditions. Sichuan Electric Power relies heavily on hydropower generation in the western mountainous areas, accounting for over 70%. The severe drought in the western flood season this year caused a decline in power generation, which in turn caused serious power shortages. This shows that natural conditions limit the development of high-energy-consumption industrial chains in Sichuan, and the trend of future industrial transfer may change.

Specification:

Panel Maker

The policy is mainly to focus on the power cuts in non-production areas, resulting in the shutdown of individual production lines. Because the overall panel supply and demand are in a state of oversupply, the impact on the industry is limited, which helps the industry to destock. Among them, the supply of a-Si is mainly affected, which will reduce the supply of 3-4Mil. of smartphone panels, accounting for about 3-4% of the supply for the month.

The main panel makers in Sichuan are BOE, HKC, Tianma, and Truly.

1. BOE:

......

2. HKC

......

3. Truly:

......

Material Maker

1. Organic light-emitting materials (Idemitsu, Merck):

......

2. Glass substrate (Corning, Tunghsu):

......

ODM/OEMs

1. Foxconn:

......

2. Changhong:

......

3. Compal:

......

4. Quanta:

......

The high temperature continues in various regions, and the power supply policies in various regions should continue to pay attention.

中文:

群智研究|四川限电对显示产业上下游影响分析

事件背景:

8月15日,四川省经济和信息化厅和国网四川省电力公司联合下发文件《关于扩大工业企业让电于民实施范围的紧急通知》:由于当前电力供需紧张形势进一步加剧,为确保四川电网安全,确保民生用电,确保不出现拉闸限电。经研究决定,从8月15日起取消主动错避峰需求响应,在全省(除攀枝花、凉山)的19个市(州)扩大工业企业让电于民实施范围,对四川电网有序用电方案中所有工业电力用户(含白名单重点保障企业)实施生产全停(保安负荷除外),放高温假,让电于民,时间从2022年8月15日00:00至20日24:00。各地要立即通知企业做好生产调整,保障保安负荷用电,迅速执行到位。

主要结论:

四川停电造成当地显示和消费电子制造企业不得不维持连续6天的低稼动率运转。目前整个消费电子行业的库存高于正常水平,做为消费电子的制造业重镇,低生产稼动率也可有助于整个行业的库存清理,推动库存更快速度下降。

面板厂:主要产线为非生产区限电控制,个别厂商产线停工,但因整体行业库存偏高,市场处于供大于求状态,将有助于产业链去化库存和缓解供需失衡。

材料厂:部分材料厂因限电产线已停产,主要依赖前期库存出货,且面板厂也备有一定周期库存,对企业运转无太大影响。

代工厂:大部分代工厂已停产,仅保留20%保安负载,此次停电将对整机制造产生影响,特别是笔记本PC整机生产。

智能手机:a-Si LCD面板供应受主要影响,将减少智能手机面板3-4Mil.pcs的供应,占当月供应约3-4%。

笔记本PC:成都地区笔记本代工产能占全国约20%,主要有广达、仁宝、富士康、纬创主力PC代工厂等。群智咨询(Sigmaintell)测算对各笔记本PC品牌出货影响程度不一,按影响程度由高到低排序为:Apple、Dell、Asus、HP、Lenovo。需关注是否会连带影响PC品牌的面板备货节奏。

根据群智咨询(Sigmaintell)分析,此次四川缺电主因为:四川电力严重依赖于西部山区水力发电,占比超7成,而今年西部汛期大旱造成发电量下降,引起严重缺电。这说明自然条件限制四川发展高能耗产业链,未来产业转移的趋势或将发生改变。

具体说明:

面板厂

主要是非生产区限电控制,个别产线停工,但因整体面板供需处于供大于求状态,对产业影响有限,有助于产业去化库存。其中,a-Si供应受主要影响,将减少智能手机面板3-4Mil.的供应,占当月供应约3-4%。

四川境内主要的面板厂有:京东方、惠科、天马、信利。

1. 京东方:

......

2. 惠科:

......

3. 信利:

......

材料厂

1. 有机发光材料(出光、默克):

......

2. 玻璃基板(康宁、东旭):

......

代工厂

1. 富士康:

......

2. 长虹:

......

3. 仁宝:

......

4. 广达:

......

全国大范围持续高温,应持续关注各地区电力供应政策。