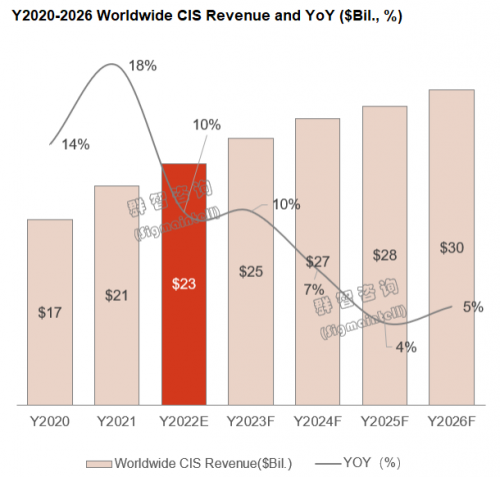

Affected by the unfavorable impact of the epidemic and international political factors, the global economic growth is weaker than expected, and the inflation rate has risen sharply. Developed countries will tighten monetary policy, and developing countries' demand will be suppressed. China's economic growth rate has slowed down, both the manufacturing and service industries are under pressure, and the momentum of domestic demand continues to be insufficient. In this macro-environment, Sigmaintell predicts that the global CMOS image sensor market will reach approximately US$22.8 billion (excluding 3D) in 2022, a YoY increase of about 10.4%. According to the analysis of Sigmaintell, there are mainly the following factors:

Firstly, the upstream CMOS image sensor wafer capacity in 2022 will increase by 19.4% YoY, especially the 28nm process capacity used in high-end pixels will increase by 38.8% YoY. At the same time, the global CMOS image sensor market demand in 2022 will only increase slightly by 2.2% YoY. Therefore, in general, the supply and demand of the overall CMOS image sensor market in 2022 will be in a state of oversupply, but some products are expected to be in a short-term shortage due to the dislocation of supply and demand.

Secondly, in terms of product planning, based on the long-term tracking research on the planning roadmaps of various sensor designers and downstream set products, Sigmaintell predicts that in 2022, the demand for 50M pixel will reach 480 million pcs, a YoY increase of 353.2%. Among them, 1.0u and above pixel products account for about 25%.

Thirdly, various types of applications will continue to plan for pixel upgrades. In particular, smartphones and automobiles have stronger demands for the upgrade of higher-end pixel sensors and other auxiliary materials, which in turn drives the average unit price of the overall image sensor to increase by 8.0% YoY. Driven by this, the global CMOS image sensor market size is expected to remain stable room for growth.

In the future, what about the upstream wafer capacity supply and expansion plan? What are the capacity and product planning of midstream sensor makers? What are the downstream set demand and product upgrade directions? In the next 3-5 years, will the supply-demand relationship in the global CMOS image sensor market be tense again? What will happen to the new technology progress of some products and the future market size in the next three years?

......

Macro Economic

Set Market

Smartphone Market Trend

Automobile Market Trend

Global Automotive Shipment Trend (2020-2026F)

Shipment Ranking of Global Automakers (2021)

Global Commercial Vehicle Market (2020-2026F)

Global Passenger Car Market(2020-2026F)

Global New Energy and Traditional Automobile Market(2020-2026F)

China Mainland Automotive Shipment Trend(2020-2026F)

Global NEV Shipment Trend(2020-2026F)

Global NEV Shipment Trend by Markers(2021)

CIS Industry Overview and Outlook (2020-2027F)

Overall Market Sales Volume Development Trend

Overall Market Sales Development Trend

Key Application Market Sales Volume Development Trend

Key Application Market Sales Development Trend

Product Unit Price Development Trend

Multi-camera Development Trend

CIS Supply by Wafer Foundry

Tech Node Development Trend

Global Wafer Foundry Capacity Development Trend (2020-2026F)

Wafer Foundry Process Development Trend (2020-2026F)

28nm Technology CIS Fab Expansion Plan(2020-2026F)

22/28nm Process CIS S&D Trend (2020-2026F)

CIS Logic Process Development Trend (BSI/FSI/Hybrid Stack/Stack TSV)(2020-2026F)

Global CIS Wafer Capacity Development Trend by Foundry

Sony CIS Wafer Capacity Development Trend

Samsung CIS Wafer Capacity Development Trend

OVT CIS Wafer Capacity Development Trend

ONSEMI CIS Wafer Capacity Development Trend

CIS Supply by Design House

8-inch Wafer Foundry Capacity Development Trend (2021-2022E)

12-inch Wafer Foundry Capacity Development Trend (2021-2022E)

Cellphone CIS Shipment Trend (2020-2026F)

Smartphone CIS Shipment Trend (21Q1-22Q4F)

Sensor Vendor Sales Volume Structure Development Trend (21Q1-22Q4F)

Sensor Vendor Sales Structure Development Trend (21Q1-22Q4F)Pixel Structure Development Trend - Sony(21Q1-22Q4F)

Pixel Structure Development Trend - Samsung(21Q1-22Q4F)

Pixel Structure Development Trend - OmniVision(21Q1-22Q4F)

Pixel Structure Development Trend - SK Hynix (21Q1-22Q4F)

Pixel Structure Development Trend -GalaxyCore(21Q1-22Q4F)

Smartphone CIS Demand Research (2020-2022F)

Brand Customer Demand Analysis(21Q1-22Q4F)

Trends of Rear Multi-camera(21Q1-22Q4F)

Pixel Structure Demand -Samsung (21Q1-22Q4F)

Pixel Structure Demand -Apple (21Q1-22Q4F)

Pixel Structure Demand -Huawei (21Q1-22Q4F)

Pixel Structure Demand -Honor (21Q1-22Q4F)

Pixel Structure Demand - Xiaomi (21Q1-22Q4F)

Pixel Structure Demand - OPPO (21Q1-22Q4F)

Pixel Structure Demand - vivo (21Q1-22Q4F)

CIS Value Chain

CIS Value Chain by Wafer Capacity - Sony(2021-2022E)

CIS Value Chain by Wafer Capacity - Samsung(2021-2022E)

CIS Value Chain by Wafer Capacity - OmniVision(2021-2022E)

CIS Value Chain by Wafer Capacity - GalaxyCore (2021-2022E)

CIS Value Chain by Wafer Capacity - Smartens(2021-2022E)

CIS Value Chain by Set Marker-Sony (2020-2021)

CIS Value Chain by Set Marker- Samsung (2020-2021)

CIS Value Chain by Set Marker- OmniVision (2020-2021)

CIS Value Chain by Set Marker- SK Hynix (2020-2021)

CIS Value Chain by Set Marker- GalaxyCore (2020-2021)

Set Marker CIS Value Chain Analysis(2021)

CIS Supply by Module

Market Share Development Trend of CIS Module Makers -Cellphone (2020-2021)

Supply Chain Structure Trend of CIS Module Makers –Cellphone (2020-2021)

Technology Trend

Wafer Stack Technology Trend

Pixel Technology Trend

Optical Size Development Trend

CIS Product Roadmap (Smartphone) (2020-2022E)

Smartphone Pixel Technology Trend (2020-2022E)

Smartphone application new technology planning progress

Multi-camera Development Trend - Smartphone

Sensor-shift& Periscope Camera Development Trend

Bridging ISP Development Trend - Smartphone (2020-2026F)

Multi-camera Development Trend by Functions -Automotive

ASDS Development Trend

3D Sensing

3D sensor industry policy analysis

Industry application

3D sensor industry chain and application hotspots

3D Sensor Market Scale Development Trend (2020-2026F)

Camera Module Price Trend

抱歉,暂无样报