Core point:

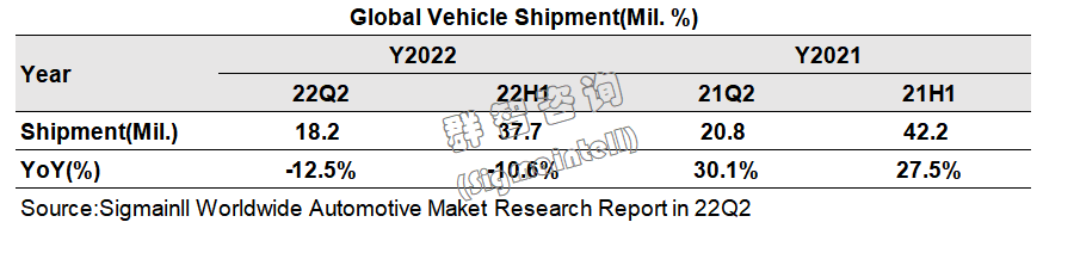

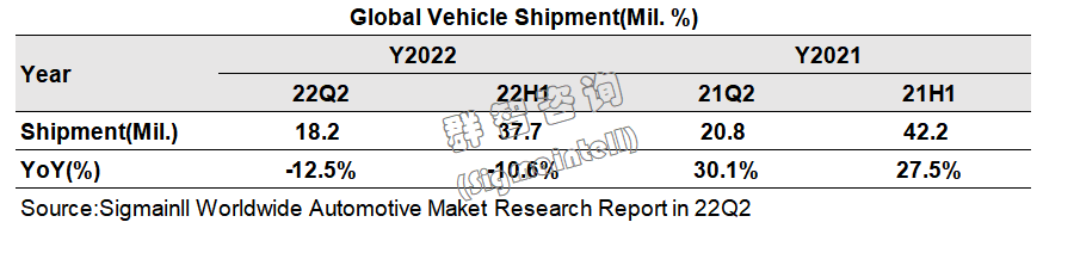

In 22H1, the global vehicle shipments will be approximately 37.7 million units, a Y-O-Y decrease of approximately 10.6%.

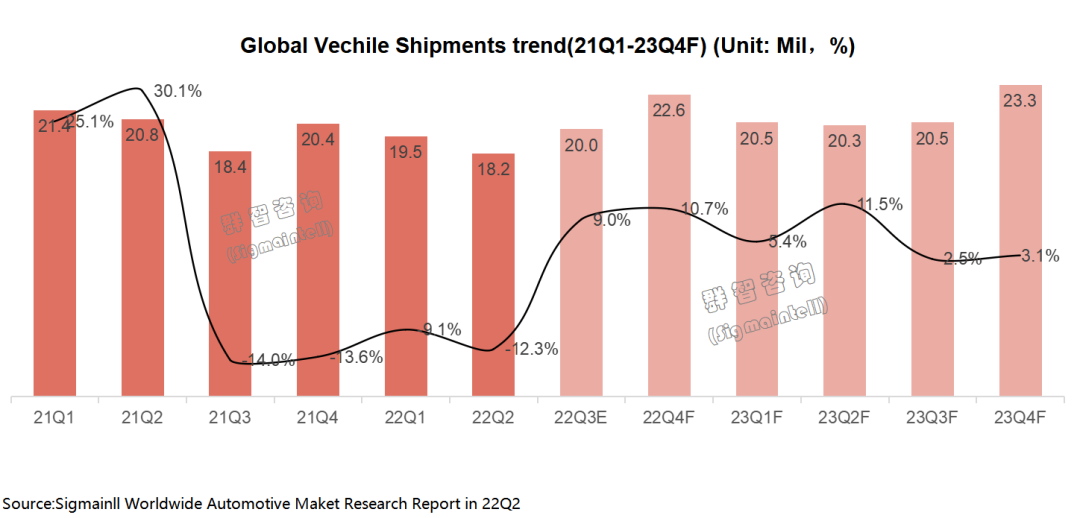

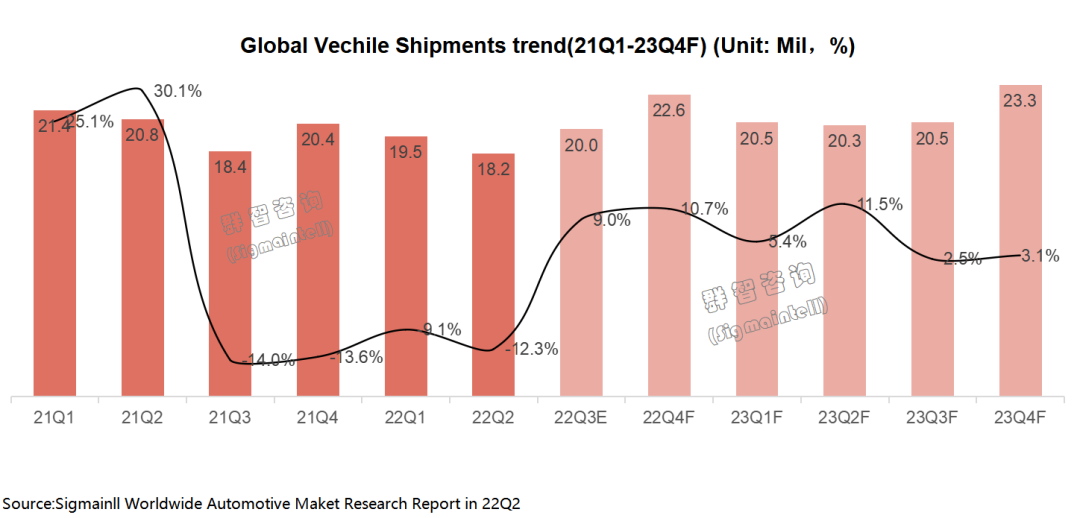

The production cut in 22Q2 resulted in a "low before and then high" shipment trend throughout the year

The continuous growth of EVs drives the rapid rebound of the industry

On the EV track, BYD has completed the transformation from "trailblazer" to "leader"

Rely on new energy, "control cost and increase efficiency" and "strategic layout"

Global Chapter: In 22H1, global auto shipments were about 37.7 million units, a Y-O-Y decrease of about 10.6%

In 22H1, global inflation and geopolitical issues continued, combined with repeated epidemics in various regions, resulting in a continuous decline in the global economy. The automobile industry is the primary industry in many countries around the world. Although it did not show a marked weakness in consumer electronics, it was also affected. According to Sigmaintell data, In 22H1, global vehicle sales (including ICE + EV) were about 37.7 million, a Y-O-Y decrease of about 10.6% and a M-O-M decrease of about 6.5%, which continued to maintain positive growth in sales throughout the year. This means that there is a lot of pressure to continue to maintain positive growth in sales throughout the year.

Supply side: The rapid penetration of smart electric vehicles has greatly increased the number of automotive chips used in advanced processes. The upstream factory capacity expansion and transfer certification cycle are long, resulting in an imbalance of supply and demand in the past year. In addition, the conflict between Russia and Ukraine in the first half of the year and the spread of the epidemic in various regions caused the shutdown of some vehicle and supporting supply chain factories. At the same time, the continuous rise in the prices of automotive raw materials such as power batteries, steel, and aluminum has caused huge pressure on the cost of automobile making.

Demand side: Due to the severe and complex international environment and the unexpected impact of the epidemic, the downward pressure on the economy has further increased. At the same time, consumer demand has also weakened. However, during this period, various countries have successively introduced a series of favorable policies for consumers to purchase cars, which has gradually recovered the downstream consumer market of automobiles. Annual car sales are expected to return to the same level as last year.

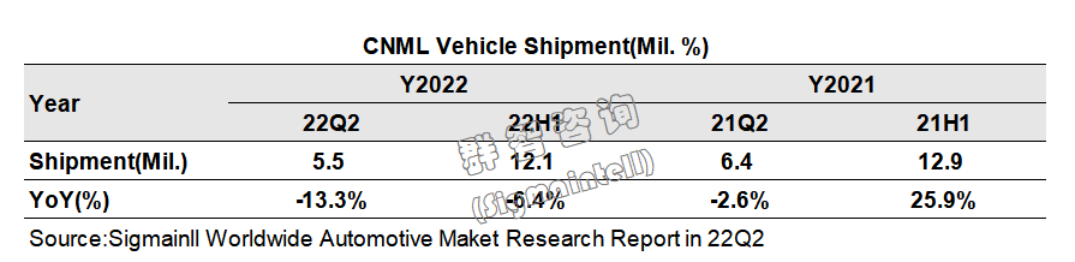

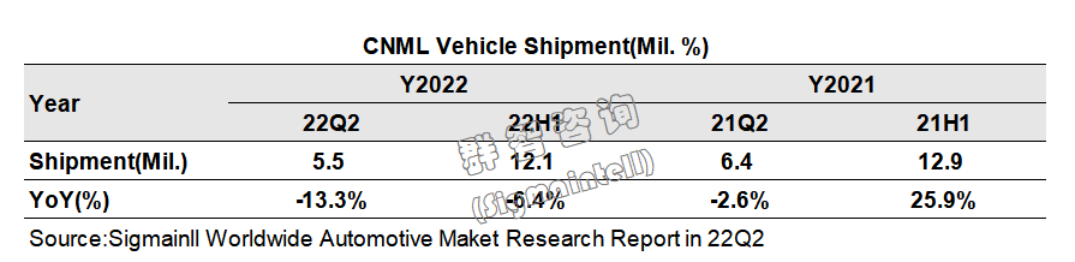

Chinese Mainland Chapiter: The production cut in the second quarter resulted in a "low before and high" shipment trend throughout the year.

In 22H1, The outbreak of COVID-19 has returned to mainland China. Lockdown and logistics restrictions have disrupted the good rhythm of the continuous growth of the auto industry. According to Sigmaintell data, the national auto sales in 22H1 will be about 12.05 million, a Y-O-Y increase fell by about 6.4%, of which April fell by 48% Y-O-Y, the highest decline in the past two years. Since the end of the second quarter, the national level has successively launched a number of measures such as sending cars to the countryside and extending subsidies. Local governments have also actively introduced local stimulus policies to promote the rapid rebound of the auto industry to recover the losses caused by production cuts in the second quarter. Overall, the Chinese mainland auto market has gradually returned to normal at the end of the second quarter, and the monthly sales volume has also turned from negative to positive Y-O-Y.

EV Chapiter: EVs continue to grow, driving the rapid rebound of the industry

EV Chapiter: EVs continue to grow, driving the rapid rebound of the industry

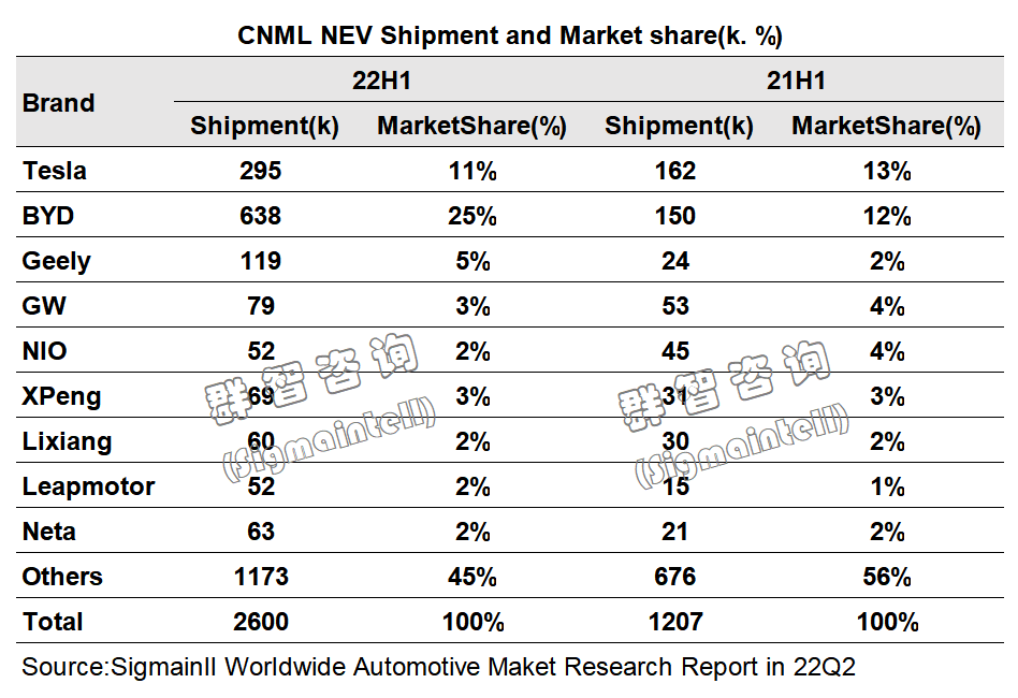

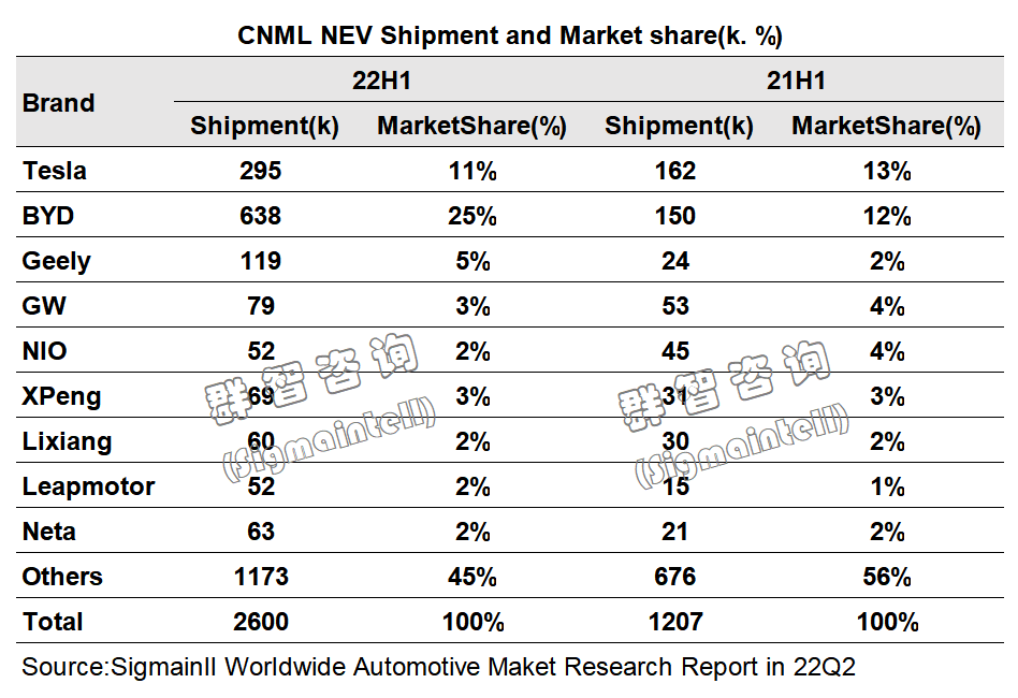

From the perspective of the EV branch, the policy orientation has made the market continue to improve. In 22H1, most countries and regions in the world still show a trend of high growth. According to Sigmaintell data, the global sales of EVs in 22H1 will be approximately 4.231 million units, a Y-O-Y increase of approximately 66%. Among them, the performance of mainland China is particularly outstanding. On the basis of the high base of 47% of the global share of EVs in 21H1, In 22H1, it will continue to grow by 115% Y-O-Y to about 2.6 million vehicles, and its market share has further increased to more than 60%. No matter how the external environment changes, EVs will remain the core force driving the growth of the auto industry throughout the second half of the year and even in the next 3-5 years.

Domestic Competition Chapiter: In the EV track, BYD has completed the transformation from "trailblazer" to "leader"

Domestic Competition Chapiter: In the EV track, BYD has completed the transformation from "trailblazer" to "leader"

In 2022, the concentration of the EV market in mainland China will gradually move closer to the industry leader. According to Sigmaintell data, In 22H1, auto giants such as Tesla, BYD, Geely, Great Wall, and other new players in the first class will account for about 55% of the market share, an increase of about 11 percentage points compared to the same period last year. With its own DMI technology, BYD's Dynasty series and Ocean series models continue to lead in sales in all price segments and have a clear leading edge. Compared with 12% in the same period in 2021, BYD's share has increased to 25%. It also brings huge competitive pressure to other car companies. On the domestic EV track, BYD has completed a complete transformation from pioneer to the leader. In 22H1, its shipment is about 638,000 units, and its annual sales are expected to sprint to 1.6 million units.

Outlook Chapiter: Relying on EV, "controlling costs and increasing efficiency" and "strategic layout"

Outlook Chapiter: Relying on EV, "controlling costs and increasing efficiency" and "strategic layout"

Under the gradual recovery of upstream raw material supply, the shift of chip production capacity from consumer electronics to automotive regulations, and the continuous promotion of downstream consumption policies by governments of various countries, the global automotive market will usher in a rebound in 22H2. Sigmaintell forecasts that in 22Q3, global vehicle shipments are expected to increase by 9% Y-O-Y to 20 million units, and annual sales are expected to return to the same level as in 2021.

Sigmaintell suggested that upstream and downstream makers in the automotive supply chain need to identify leading new energy brand customers to ensure their own profitability and achieve long-term sustainable and stable operations. At the same time, we must continuously enhance our core competitiveness. In the face of downstream customers, we continue to develop models with higher intelligent functions. In addition to improving their own software and hardware technical capabilities, component makers should also try to control costs within a reasonable range. The EV market will be a battleground for the military in the next 5-10 years. Controlling costs, increasing efficiency, and strategic layout will help players in the automotive industry chain remain new for a long time.

中文:

控本增效、布局新能源——2022年上半年全球汽车市场总结

核心观点:

2022上半年全球汽车出货约3770万辆,同比下降约10.6%

二季度减产致全年呈现“前低后高”出货趋势

新能源车持续增长,带动产业快速反弹

电车赛道,比亚迪从“开荒”到“领军”完成蜕变

倚靠新能源,“控本增效” “战略布局”

全球篇:2022上半年全球汽车出货约3770万辆,同比下降约10.6%

刚刚过去的2022年上半年,全球通胀、地缘政治问题不断升级,叠加各地区疫情反复,导致全球经济处于持续下行状态。而汽车工业作为全球众多国家的首要产业,虽未表现出消费电子产品的明显疲软态势,但也受到了波及。根据群智咨询(Sigmaintell)数据,2022年上半年全球汽车销量(含燃油+新能源)约3770万,同比下滑约10.6%,环比也下滑约6.5%,这给全年销量继续保持正向增长带来了不小的压力。

供应端:智能电动汽车的快速渗透使得先进制程的汽车芯片用量大增,上游晶圆厂产能扩张及转移认证周期较长,导致近一年内一直处于供需不平衡的状态。以及上半年俄乌冲突叠加全球各地疫情多次蔓延,导致部分整车及配套供应链工厂停产,同时动力电池、钢材、铝材等汽车原材料价格持续上涨造成汽车制造成本压力巨大。

需求端:由于严峻复杂的国际环境和超预期的疫情冲击,经济下行压力进一步增加,消费者需求疲软状况开始显现。但各国在此期间陆续推出一系列消费者购车利好政策,使得汽车下游消费市场逐渐回暖,全年汽车年销量有望恢复到去年同一水平。

国内篇: 二季度减产致全年呈现“前低后高”出货趋势

上半年中国大陆地区疫情多点爆发,封控、物流受限使得汽车产业持续增长的良好节奏被打乱,根据群智咨询(Sigmaintell)统计,2022年上半年全国汽车销量约1205万辆,同比下降约6.4%,其中4月份同比下滑48%,为近两年最高下滑幅度。自二季度末以来国家层面陆续推出了汽车下乡、补贴延期等多项举措,各地政府也积极出台地方性刺激政策来推动汽车产业快速反弹,以挽回二季度减产造成的损失。总体看来,二季度末国内汽车市场已逐渐恢复到正常水平,月销量同比也由负转正。

新能源篇: 新能源车持续增长,带动产业快速反弹

从新能源汽车分支来看,政策导向使得市场持续向好,2022上半年全球大部分国家地区仍然呈现出高增长的态势。根据群智咨询(Sigmaintell)统计数据,2022年上半年全球新能源汽车销量约423.1万辆,同比增长约66%。其中,中国大陆地区的表现尤为出色,在2021上半年占新能源汽车全球份额47%高基数的基础上,2022年上半年继续同比增长115%,达到约260万辆,市场份额也进一步提升至超过60%。不论外部环境如何变化,新能源汽车仍将是整个下半年乃至未来3-5年带动汽车产业增长的核心力量。

国内竞争篇:电车赛道,比亚迪从“开荒”到“领军”完成蜕变

进入到2022年,中国大陆地区新能源汽车市场集中度由百花齐放逐渐向行业龙头靠拢。群智咨询(Sigmaintell)数据显示,2022年上半年特斯拉、比亚迪、吉利、长城等车企巨头及第一梯队新势力玩家的市场份额占比累计达到约55%,相比去年同期增长约11个百分点。值得注意的是,其中主要变化来自于比亚迪。比亚迪凭借着其自有的DMI技术,其旗下王朝系列和海洋系列的车型在各价位段销量持续领跑且领先优势明显,相比2021年同期的12%份额增长到了25%,持续上量的同时也给其他车企带来了巨大的竞争压力。在国内的新能源电车赛道上,比亚迪已经完成了从开荒者到领军者的彻底蜕变,2022年上半年出货约63.8万台,全年销量有望冲刺160万台大关。

展望篇: 倚靠新能源,“控本增效” “战略布局”

在上游原材料供应逐渐恢复、芯片产能从消费电子向车规转移、叠加各国政府对下游消费政策的持续推动作用下,全球汽车市场将在2022年下半年迎来反弹。群智咨询(Sigmaintell)预测,2022年三季度全球汽车出货量有望实现同比增长9%,达到2000万台,全年销量也有望恢复到与2021年相同水平。

纵观全局,新能源汽车在整体市场中的份额仍然会持续提升,群智咨询(Sigmaintell)预测,新能源汽车到2027年市场份额将超过30%。据此,群智咨询(Sigmaintell)建议,汽车供应链上下游厂商需要找准头部新能源品牌客户切入,来确保自身盈利水平,实现长期持续稳定运营,同时也要不断增强自身核心竞争力。面对下游客户不断开发更高智能化功能的车型,零部件厂商除对自身软硬件技术能力要求需有所提升外,同时还要尽可能将成本控制在合理范围,新能源汽车市场将会是未来5-10年的兵家必争之地,控本增效、战略布局将助力汽车产业链玩家历久弥新。