Core insights:

According to Sigmaintell’s data, shipments in the Chinese market are expected to drop to 38 million units in 2022, a YoY decline of more than 5%. Hit a record low in nearly a decade, and market expectations in 2023 are still not optimistic.

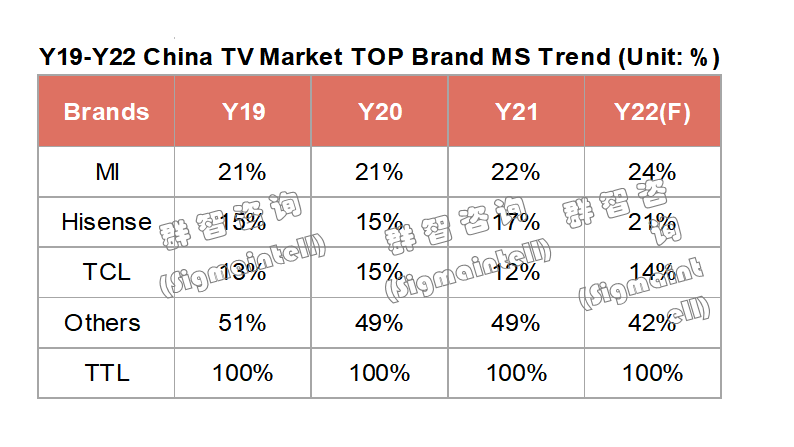

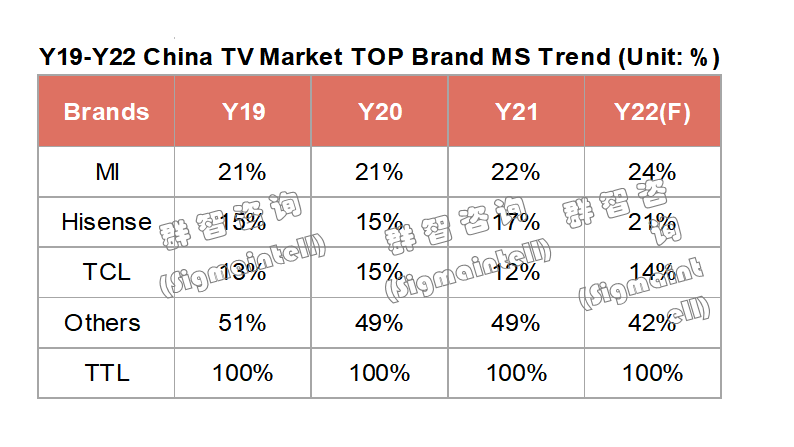

In the context of the sluggish overall demand in the Chinese market, most brands' shipments have met different degrees of decline. Driven by the advantages of supply chain resources, the top 3 brands actively implemented the dual-brand strategy and achieved contrarian growth in 2022. The concentration of top3 brands was further improved. According to Sigmaintell statistics, the market share of the top 3 brands in China's TV market will increase significantly from 51% in 2021 to 58% in 2022, demonstrating the strong aggregation effect of leading brands.

Reviewing the epidemic so far, the development of the Chinese market has not been satisfactory, and there are great market risks. The "Double Eleven" year-end promotion will undoubtedly become the market traffic highland in Y22H2. There will be more intense market competition in the Chinese panel market with low-cost and fast-conducting ends.

Factors such as the epidemic and real estate have caused demand to shrink more than expected, and the Chinese market has entered a difficult second half.

Looking back on Y22H1, we have experienced the hottest summer and also experienced the economic winter. Epidemic, geopolitical conflicts, and inflation have continued to affect the Chinese economy.

Decline in rigid demand: The real estate sales area and sales showed a YoY decline of 20%. Despite frequent easing policies on real estate, the industry continued to experience cold weather. The TV industry is closely related, and the demand will inevitably be affected. In addition, the rise of Internet short videos, fragmented entertainment time and content, the entry of projectors into the living room, and other inhibitory factors continue to challenge the traditional application scenarios of TV, resulting in the rigid red line from before the epidemic. The annual number of more than 50 million units has dropped to less than 40 million units.

According to Sigmaintell’data, the Chinese market shipments are expected to drop to 38 million units in 2022, a YoY decline of more than 5% and a record low in the past ten years. Market expectations in 2023 are still not optimistic.

Consumption downgrade:

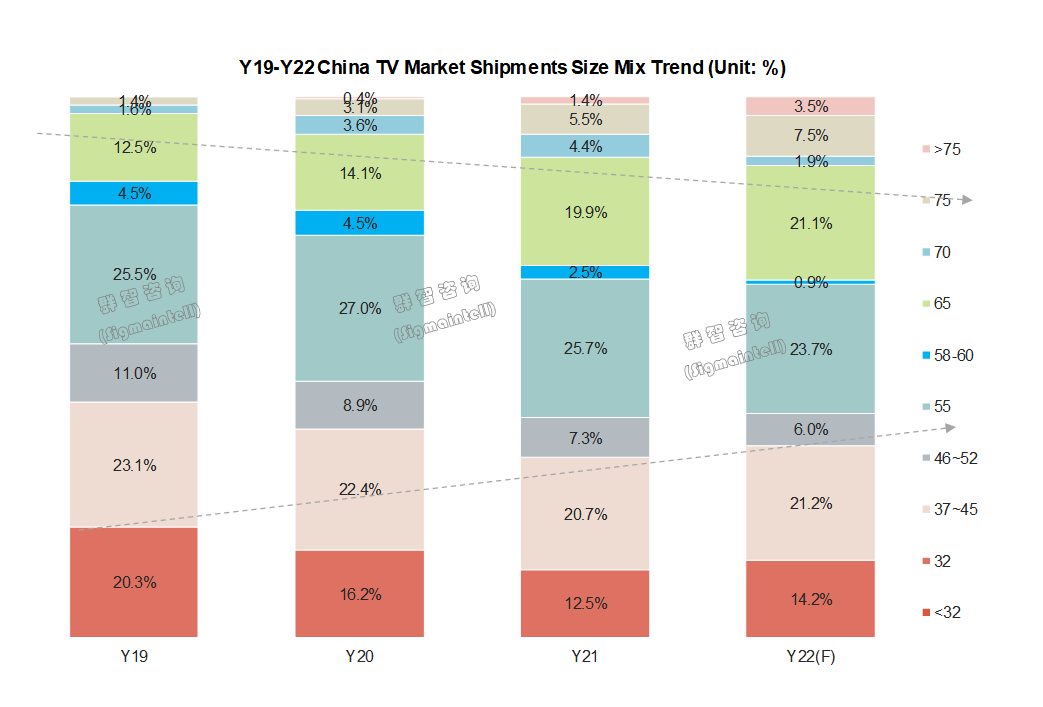

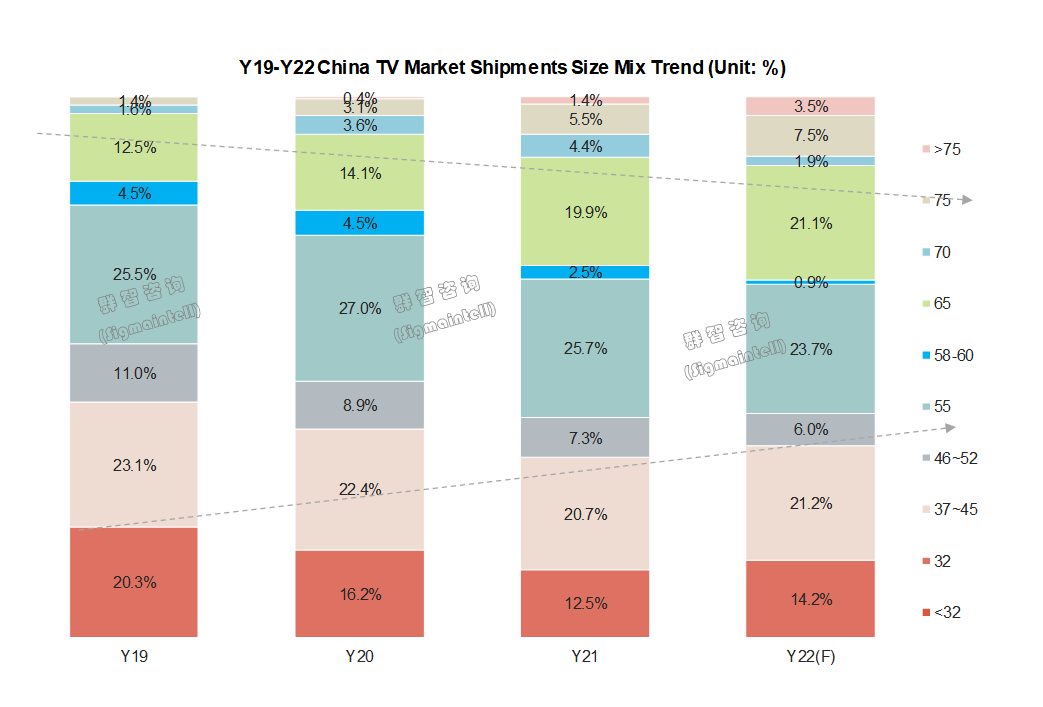

Consumption downgrade: The continuous spread of the epidemic in many provinces and cities has affected the real economy, service industry, tourism, etc. The pressure of consumption downgrade comes from the high unemployment rate, declining consumer demand, rising household savings, and turning to a conservative consumption attitude. It can also be seen from the TV product structure in the Chinese market that, according to Sigmaintell’s data, the demand for 32”/43” small size has recovered. At the same time, the demand for extra-large sizes of 75” and above has increased significantly due to the positive layout of the brand, the demand orientation of profit margins, and the impact of the demand of the consumer market. However, the large-size process in the Chinese market that has been going on for many years has slowed down. As panel costs continue to drop, the trend of large-scale size will recover in 2023.

Industry countermarch and rise brand concentration

Industry countermarch and rise brand concentration

In the context of the sluggish overall demand in the Chinese market, most brands' shipments have shown a different degree of decline.

The growth of top3 brands bucked the trend in 2022, mainly due to the active implementation of the dual-brand strategy and the advantages of supply chain resources, and the concentration of top3 brands has been further improved. According to Sigmaintell statistics, the market share of the top 3 brands in China's TV market will increase significantly from 51% in 2021 to 58% in 2022 and shows a solid combined effect of leading brands.

Hisense

Market strategy - clear Vidda's mid-to-low-end positioning, targeting young consumers.

Hisense

Market strategy - clear Vidda's mid-to-low-end positioning, targeting young consumers.

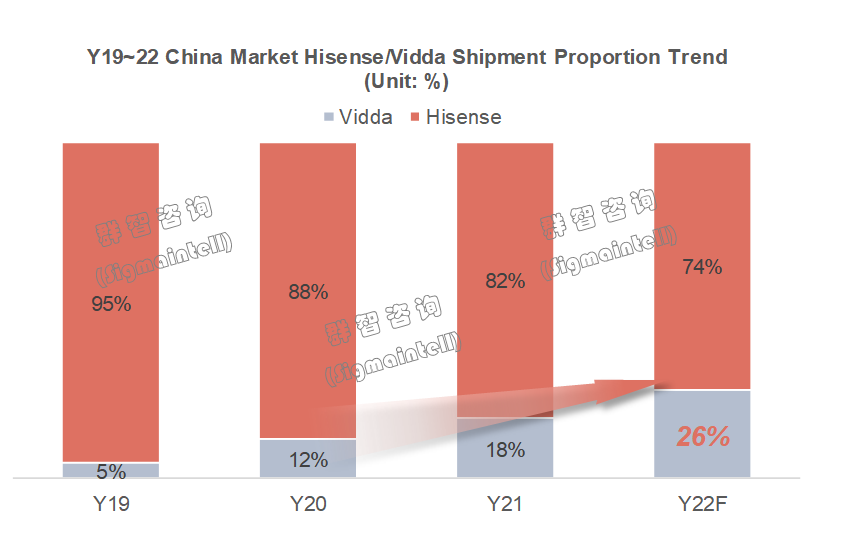

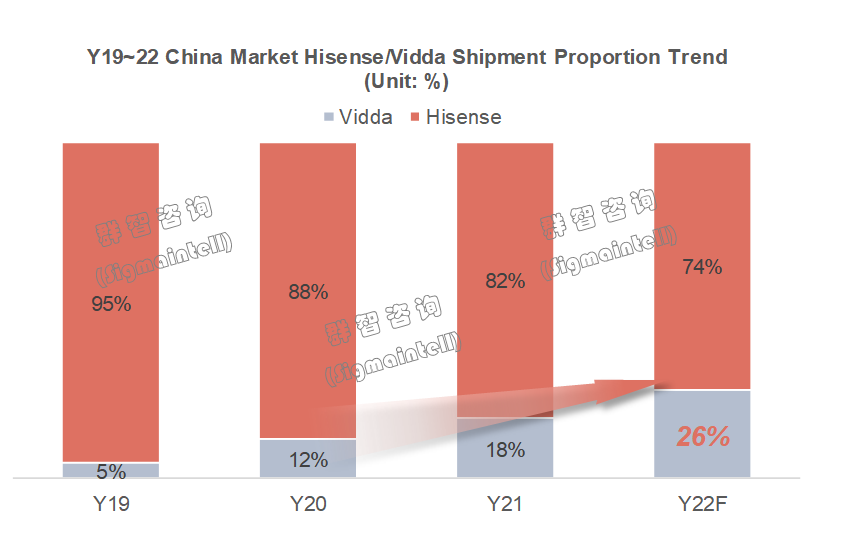

Hisense (Hisense) has been aggressive in the Chinese market strategy after a short period of overseas market epidemic premium recession. In 2021, the product positioning of the Vidda brand was focused on audio-visual entertainment and products with precise layouts, such as games and music for young people. With the making, design, and channel capabilities and the active release of mid-to-low-end channel resources, the Vidda brand has achieved rapid growth from small and medium sizes. According to Sigmaintell’s data, Hisense is expected to ship 8 million units in the Chinese market in 2022, a YoY increase of over 17%. Among them, Vidda's shipments in the Chinese market will exceed 2 million units, achieving rapid growth and becoming an important cornerstone to support the development of Hisense's Chinese market.

Product strategy - high refresh combined with large size to expand the high-end market increment

Product strategy - high refresh combined with large size to expand the high-end market increment

Hisense has also clarified a positive development direction in the strategic layout of high-end products. Through the active layout of high refresh and ultra-large size, Hisense has won more market share in the mid-to-high end of the Chinese market. The U7 series fully reflects this iteration strategy. As a representative of high-brush products, U7H uses a native 144Hz panel to achieve 240Hz screen output through technical processing. With 100-level partition light control and image quality adjustment, it can achieve high-quality output in different usage scenarios such as games, movies, and events. At the same time, the 98" U7G-Pro is deployed in the U series for the first time, which fully reflects its positive attitude in terms of super size.

TCL

Market strategy - Thunderbird brand pushed up market share recovery.

Also affected by the decline in overseas market demand due to the fading dividends of the epidemic and TCL's lack of timely support in the Chinese market due to product and market positioning reasons, TCL did not promote growth until the "618" promotional season in the middle of the year after a long recession. The sub-brand Thunderbird's promotion and the TCL brand's promotion of mid-end large-size products also continued to be active, pushing up the shipment performance in the Chinese market. According to research data from Sigmaintell, TCL's shipments in the Chinese market are expected to reach 5.2 million units in 2022, a YoY increase of nearly 5%, of which Thunderbird's shipments in the Chinese market are expected to be close to 800,000 units, and will still be shipped in 2023. maintain a slight recovery.

Product strategy - Mini LED combined with super-large size and technology sink to achieve scale growth.

Product strategy - Mini LED combined with super-large size and technology sink to achieve scale growth.

TCL's product strategy has always used the combination of Mini LED and large-size products and benchmarked high-end products from competitors. TCL is more aggressive in the layout of Mini LED products this year. After the launch of X11 and C12E at the beginning of the year, the highly cost-effective Mini LED product Q10G was also launched. Considering the high-division Mini LED BLU tech and high refresh, the 75" Mini LED product reached below 10,000 yuan, with strong market competitiveness. The "618" promotion season's first show shines brightly. The scale growth is achieved through the sinking of MiniLED BLU technology.

Xiaomi (MI)

Market strategy - Weakening REDMI operation strategy and increasing offline channel sales.

As the brand with the largest market share in China's TV market, Xiaomi (MI) is also an early practitioner of the dual-brand strategy. REDMI is positioned at the mid-to-low end to support the brand’s growth. In 2022, on the one hand, the Chinese market strategy will turn to product profitability, weakening the concept of the Redmi brand. On the other hand, the flexible supply chain strategy will give it a low-cost advantage. The Redmi brand was able to support Xiaomi's continued aggressive pricing strategy for EA entry-level products. The proportion of Xiaomi compared to Redmi will recover in 2022. At the same time, improving offline store efficiency will support the relatively stable market size of Xiaomi in China. According to Sigmaintell’s data, Xiaomi is expected to ship 9 million units in the Chinese market in 2022, maintaining steady growth.

Product Strategy - Oversized size as the main focus to meet market demand

Product Strategy - Oversized size as the main focus to meet market demand

The Chinese market is a special market with price sensitivity and strong demand for large sizes. MI closely follows the market characteristics in terms of product layout: REDMI-MAX has made 86”/98” the ultimate cost-effectiveness in the super-large size. Pull the price of 80"+ to 5,000 yuan and promote the rapid popularization of 80"+ products in the Chinese market; At the same time, this year's new ES-Pro 86" achieves a high refresh rate of 120Hz on the basis of super large size. As a mid-end product of the MI brand, it achieves comprehensive competition on the super large size and high refresh tracks.

In the cold winter of the industry, challenge "danger" and "opportunity."

Looking back on the epidemic so far, the development of the Chinese market has not been satisfactory, and there are large market risks:

(1) The epidemic has caused economic and demand stagnation and changes in user habits, which have had a huge impact on the Chinese TV market. Under the concepts of "screenless" and "home theater,” projection TVs are actively grabbing users. As a result, the demand for flat-panel TVs has declined, and it is difficult to rely on the domestic market to reduce panel capacity. In the end, the relationship between supply and demand has deteriorated, making brands and panel makers fall into "in-roll" competition.

(2) The lack of innovative TV product iterations and the increasingly obvious product homogeneity have inhibited consumption and replacement demand. There is a risk of industry-wide low profits brought about by low-price competition in the market.

(3) The fragmentation between the single-use scene of TV products and the current diversified use requirements of the scene is becoming more and more prominent, and there is a lack of continuous promotion of the development of new scenes by functional iteration.

The "Double Eleven" year-end promotion will undoubtedly become the market traffic height in Y22H2. In the Chinese market, where panels are low-cost and fast-conducting terminals, there will be more intense market competition. Combined with supply-side trends, Sigmaintell recommends the following:

(1) Panel prices have dropped to historically low levels, panel makers continue to reduce production, and the fluctuations in panel costs will stabilize. Set makers can stock up according to the brand’s products and market characteristics to consolidate the panel supplier partnership. To meet market challenges with a "win-win" mentality.

(2) Build a competitive barrier with technological progress and iteration: High refresh rate and large size are potential markets with solid growth momentum. Brands can combine their technical characteristics and continue to make efforts to derive products that meet market demand. Under the promotion, accelerate the iteration of products and technologies, and at the same time, enhance the competitiveness of LCD technology compared with competitive technologies such as projection.

The market winter has come, the demand is sluggish, and the industry situation is not optimistic, but there are often opportunities for innovation and reconstruction in adversity. Under stable operation, enterprises still need to actively face the challenges, practice their internal skills hard, and look for opportunities in adversity.

(3) Increase the development of market segments, such as game TV brings rapid growth of high-brush products; telecommuting and social needs promote product improvement; educational applications accelerate the development of eye protection functions, etc. Precise market segment positioning and product involvement will become a new driving force for the growth of flat-panel TVs, bucking the trend.

中文:

需求不振下的逆行者:中国TV市场迎来品牌格局全面调整

核心观点

根据群智咨询(Sigmaintell)研究数据,预计2022年中国市场出货量回落至3800万台,同比下滑超5%,创近十年历史新低,2023年市场预期仍不乐观

在中国市场整体需求持续低迷的情况下,大部分品牌出货均呈现不同幅度下降,而Top3品牌积极执行双品牌策略以及在供应链资源优势的推动下,2022年取得了逆势增长,Top3品牌集中度进一步提升。根据群智(Sigmaintell)统计数据显示,中国电视市场Top3品牌的市场份额将由2021年的51%大幅提升到2022年的58%,头部品牌聚集效应凸显。

回顾疫情至今,中国市场发展始终不尽如人意,存在较大市场风险。“双十一”年终大促无疑将成为下半年的市场流量高地,在面板低成本快速传导终端的中国市场,将产生更激烈的市场竞争。

疫情、房地产等因素致使需求超预期收缩,中国市场进入艰难下半场。

回顾2022年上半年我们经历了最炎热的夏天,也同样经历了经济寒冬,疫情,地缘冲突及通胀对中国经济造成持续影响。

刚需下降: 各地虽房地产松绑政策频出,但行业仍持续遇冷,销售面积及销售额均呈现同比20%下滑,电视产业与之密切相关,需求必将受到波及;另外互联网影响下的短视频兴起,碎片化的娱乐时间和内容,投影仪进入客厅,持续挑战电视传统应用场景,导致刚性红线已然从疫情前的每年5000万台以上下降到不足4000万台规模。

根据群智咨询(Sigmaintell)研究数据,预计2022年中国市场出货量回落至3800万台,同比下滑超5%,创近十年历史新低,2023年市场预期仍不乐观。

消费降级: 多地疫情持续散发,实体经济、服务行业、旅游业等持续受到影响,失业率维持高位,消费需求下滑,居民储蓄持续攀升,消费态度转向保守,从而引发消费降级。从中国市场产品结构也可以看出,根据群智咨询(Sigmaintell)研究数据,32”/43”小尺寸需求有所恢复。同时,由于品牌积极的布局、利润率的需求导向、消费市场的需求影响,75”及以上超大尺寸需求有明显增长,中国市场持续多年的大尺寸化进程有所减缓。随面板成本持续下探,预计2023年大尺寸化趋势将回归正轨。

行业逆行者,推高品牌集中度

在中国市场整体需求持续低迷的情况下,大部分品牌出货均呈现不同幅度下降,而Top3品牌积极执行双品牌策略以及在供应链资源优势的推动下,2022年取得了逆势增长,Top3品牌集中度进一步提升。根据群智(Sigmaintell)统计数据显示,中国电视市场Top3品牌的市场份额将由2021年的51%大幅提升到2022年的58%,头部品牌聚集效应凸显。

海信(Hisense)

市场策略-清晰Vidda中低端定位,面向年轻消费群,拉动中国市场规模增长

海信(Hisense)在经历短暂海外市场疫情红利衰退期后,中国市场策略激进,2021年明确Vidda品牌产品定位,主打影音娱乐,面向年轻人的游戏及音乐领域精细布局产品,叠加海信品牌的制造、设计和渠道能力,主动释放中低端渠道资源,从中小尺寸起步,助力Vidda品牌迅速增长。群智咨询(Sigmaintell)研究数据显示,预计2022年海信在中国市场出货将达到800万台,同比增长超17%,其中Vidda在中国市场出货量将超过200万台,实现高速增长,成为支撑海信中国市场发展的重要基石。

产品策略-高刷新结合大尺寸,拓展高端市场增量

海信品牌在高端产品策略布局方面也明确积极的发展方向,通过高刷新以及超大尺寸方面的积极布局,在中国市场中高端赢得更多市场份额。其中U7系列充分体现了这一迭代方向,U7H作为高刷产品的代表,原生144Hz面板通过技术处理实现240Hz画面输出,配合百级分区控光和画质调教,实现游戏,电影,赛事等使用场景下的高画质输出。同时首次在U系列中布局98”U7G-Pro,充分体现其在超大尺寸方面的积极态度。

TCL

市场策略-雷鸟发力,拉动市场份额恢复

同样受疫情红利消退导致海外市场需求下滑影响,TCL在经历较长衰退期后,中国市场由于产品和市场定位原因并没有及时支撑,直至年中“618”促销季开始发力,子品牌雷鸟促销加码,同时TCL品牌在中端大尺寸产品促销也持续积极,共同作用推高中国市场出货表现。根据群智咨询(Sigmaintell)研究数据,预计2022年TCL在中国市场出货将达到520万台,同比增长接近5%,其中雷鸟中国市场出货量预计将接近80万台,2023年仍将维持小幅恢复。

产品策略-MiniLED结合超大尺寸,技术下沉实现规模增长

TCL产品策略始终坚持MiniLED结合大尺寸产品路线,对标友商高端产品,今年在MiniLED产品的布局方面更加的激进,在年初相继推出X11和C12E后,还推出极具性价比的MiniLED产品Q10G,在兼顾高分区MiniLED背光技术和高刷新加持下,将75”MiniLED产品做到万元以下,具备强市场竞争力,在“618”促销季首秀中大放异彩,通过MiniLED背光技术下沉赢得规模增长。

小米(MI)

市场策略-弱化REDMI运营策略,增加线下渠道销售

小米(MI)作为中国TV市场占有率第一的品牌,同时也是双品牌策略较早的践行者,红米(REDMI)定位中低端,支撑品牌规模增长,2022年中国市场策略一方面转向产品盈利性导致弱化红米品牌概念,另一方面,灵活供应链策略使其拥有低成本优势,得以支持小米的EA入门级产品持续积极价格策略,小米较红米占比在2022年有所恢复,同时线下门店店效的提升,支撑小米中国市场规模维持相对稳定,群智咨询(Sigmaintell)研究数据显示,预计2022年小米在中国市场出货将达到900万台,维持稳定增长。

产品策略-超大尺寸作为主基调,贴合市场需求

中国市场作为价格敏感和大尺寸需求强烈的特色市场,MI在产品布局方面紧跟市场特点,在超大尺寸持续发力,REDMI-MAX将86”/98”做到了极致性价比,将80”+价格拉进5000元大关,推动80“+产品在中国市场的快速普及,同时今年的新品ES-Pro 86”,在超大尺寸基础上实现120Hz高刷新率,作为MI品牌中端产品,实现在超大尺寸高刷赛道综合竞争。

身处行业寒冬,挑战“危”与“机”

回顾疫情至今,中国市场发展始终不尽如人意,存在较大市场风险:

(1)疫情导致经济和需求停滞和用户习惯改变,对中国电视市场造成巨大冲击。在“无屏”和“家庭影院”等概念下,投影电视积极抢夺用户,平板电视市场需求下滑,面板产能去化难以依托国内市场,供需关系恶化,使得品牌及面板厂商均陷入“内卷”式竞争。

(2)电视产品迭代缺乏创新,产品同质化愈发明显,抑制消费和换机动力,存在低价竞争带来的全行业低利润风险。

(3)电视产品单一使用场景和目前场景多元化的使用需求割裂现象愈发凸显,缺乏功能迭代对新场景发展的持续推动。

“双十一”年终大促无疑将成为下半年的市场流量高地,在面板低成本快速传导终端的中国市场,将产生更激烈的市场竞争。结合供应端变化趋势,群智咨询(Sigmaintell)建议如下:

(1)面板价格已下探至历史低位,面板厂商减产动作持续推进,面板成本变化波动将趋于平稳,整机厂商可根据品牌自身产品和市场特点针对性备货,巩固面板供应商合作关系,以“共赢”心态共同迎接市场挑战。

(2)用技术进步和迭代构筑竞争护城河:高刷新率以及大尺寸作为潜力发展市场,具备较强增长动能,品牌可结合自身技术特点,持续发力,衍生贴合市场需求产品,在成本的推动下,加速产品和技术迭代,同时提升LCD技术相较于投影等竞争性技术的竞争力。

(3)加大细分市场开拓,如:游戏电视带来高刷产品的高速发展;远程办公和社交需求推动产品改良;教育应用加速护眼功能开发等,精准的细分市场定位和产品涉及将成为驱动平板电视逆势增长的新动力。

市场寒冬已至,需求不振,行业形势始终不容乐观,但逆境中往往存在革新和重建的机会。在稳健经营前提下,企业还需积极迎战,苦练内功,寻找逆境中的机会。