核心观点:

需求:终端需求弱恢复,面板策略备货需求走强

供应:按需生产、强议价能力是上半年供应端的主要特点

供需及价格:LCD TV面板价格短期迎来超预期上涨

步入2023年,电视终端需求依然维持“弱恢复”,但随着电视产业供应链中各个环节的库存逐步趋于健康,整机厂商备货信心恢复;同时,供应端面板厂商集中度持续提升且通过持续积极控产实现供需形势转变。群智咨询(Sigmaintell)认为,全球LCD TV面板市场陷入了“一半夏天,一半冬天”的割裂局面,上半年在策略性备货需求支撑下供需环境趋于紧张,带动LCD TV面板价格短期涨幅超预期。

需求:终端需求弱恢复,面板策略备货需求走强

2023年,受宏观环境影响,全球电视终端需求呈弱恢复态势,但部分区域需求存在成长机会。北美渠道库存压力缓解,渠道拉货恢复正常,在经济和成本等因素的支撑下有望带来规模增长和结构优化;东南亚市场经济向好,将会是全球电视市场大盘的重要支撑;其他区域电视需求依然疲弱,但整体来看全球电视需求有望迎来弱恢复。

经历深度去库存周期后,产业链库存压力缓解。经历了超过半年来自渠道和品牌的深度去库存周期,春节过后全球主要区域渠道库存和主要电视品牌的面板库存已逐步趋于健康。同时,面板厂通过积极的产能控制,面板厂自身的库存亦随之降低到相对健康水平。群智咨询(Sigmaintell)统计数据显示,截至2023年年初,品牌整体库存水位明显下降至11周,库存健康;液晶电视面板厂商的整体库存也下降到1.7周水位,库存降到相对健康水位,预计2023年上半年面板厂库存有望在需求和产能相向调整中实现动态健康。

涨价预期下,中国厂商策略备货需求走强,国际品牌备货需求维持保守。国际品牌与中国厂商在采购策略层面走向分化。国际品牌对终端市场需求缺乏信心,一季度采购需求维持保守,采购数量同比下降20%以上。中国品牌对于面板价格周期较为敏感,春节后在液晶电视面板价格上涨的预期下纷纷开始抄底备货。但在终端需求难以期待强恢复的预期下,要警惕此种备货节奏前移将可能透支下半年面板采购需求,从而带来供需和价格因需求走弱而产生的波动。

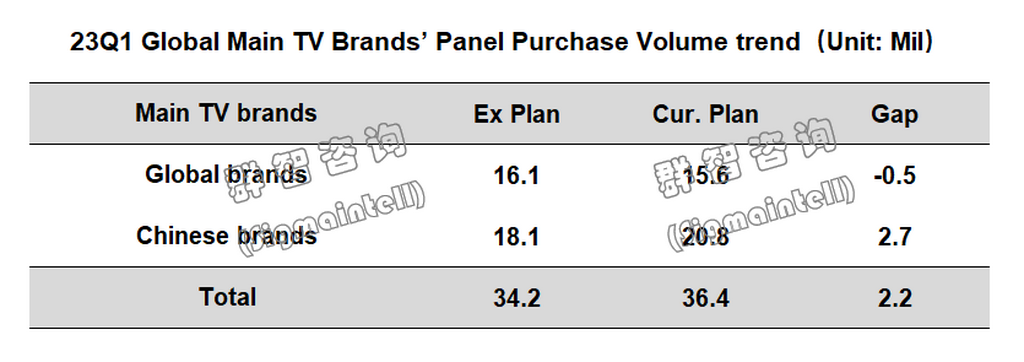

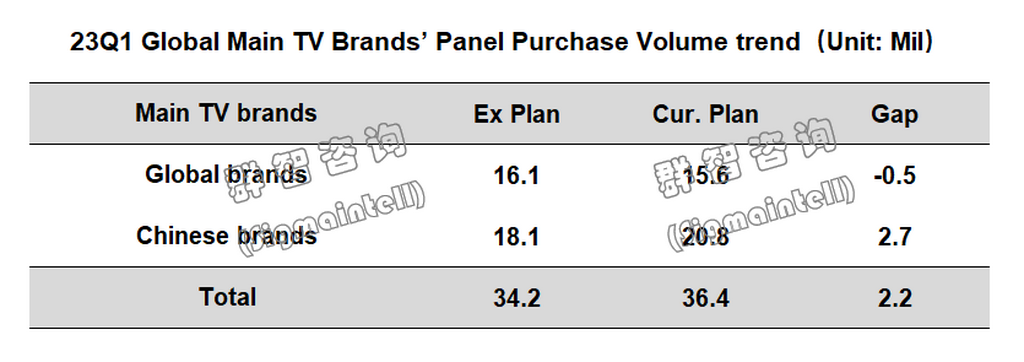

群智咨询(Sigmaintell)统计数据显示,全球Top9品牌2023年一季度电视面板采购3640万片,在中国品牌策略备货带动下,对比春节假期前的采购计划增加了220万片,短期来看液晶电视面板备货需求走强。

供应:按需生产、强议价能力是上半年供应端的主要特点

供应:按需生产、强议价能力是上半年供应端的主要特点

阶段性的控产使得库存包袱不再成为掣肘面板厂策略的核心要素,供应集中度的进一步提升为面板厂扭亏策略的强势推行提供了基础。稼动率:中国大陆厂商践行“按需生产,动态控产”,台厂产能谨慎恢复,韩厂产能维持低位根据群智咨询(Sigmaintell)调研数据显示,面板厂从22Q3开始积极减产,今年一季度的整体稼动率维持71%的低位水平。在整机厂商采购需求强劲恢复的支撑下,预计二季度G6及更高LCD面板产线稼动率逐步恢复至接近80%水平。

大陆面板厂执行“按需生产,动态控产”策略。为尽快实现扭亏目标,扭转供需过剩的局面,大陆面板厂商坚持“按需生产,动态控产”策略。其中1月春节假期期间控产最为明显,2~3月随着备货需求的恢复投片随之显著增长。总体来说,大陆面板厂商仍在执行“按需生产,动态控产”的策略。

台厂稼动率谨慎恢复。友达(AUO)在2022年率先启动了大幅减产行动且产能恢复速度缓慢,但随着库存压力缓解及品牌备货需求恢复,G8.5代线产能逐步恢复,但G6~G7.5代线依然处于控产状态。群创(Innolux)减产主要集中在G7.5代线,随着中国客户需求走强,其稼动率也恢复至较高水平。

韩厂产能维持低位。受高成本及低价格拖累,韩厂已基本退出LCD TV面板供应,仅LGD 保留广州一条G8.5代线,当前计划将在较长时间内保持约50%的低稼动率运营。

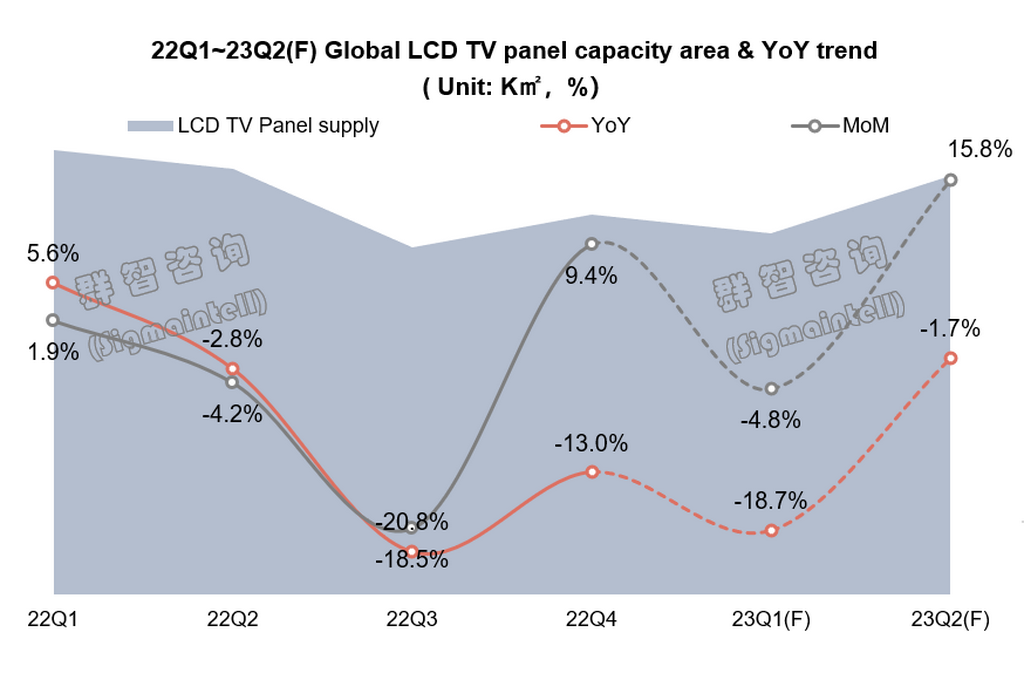

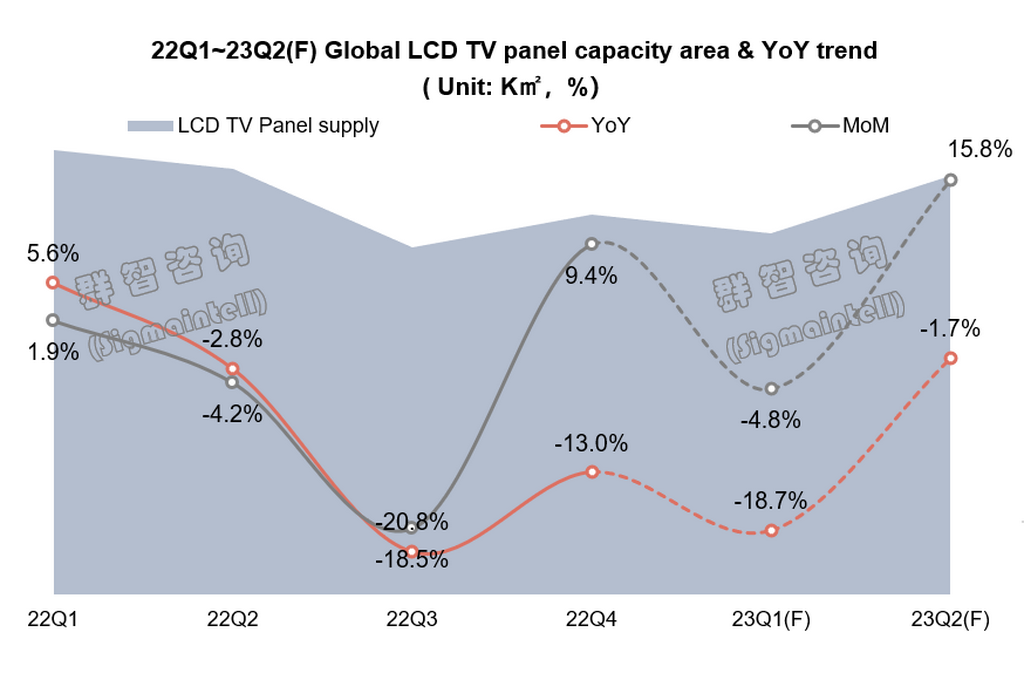

根据群智咨询(Sigmaintell)数据测算,在面板厂控产及韩厂产能退出影响下,一季度全球LCD TV面板供应面积同比大幅下降18.7%,面板厂商依然处于控产状态。二季度在面板需求支撑下,面板供应面积同比下降1.7%,环比增长15.8%。

集中度:Top3面板厂主流尺寸市场份额超70%,议价能力进一步提升。

集中度:Top3面板厂主流尺寸市场份额超70%,议价能力进一步提升。

近几年,大陆面板厂通过并购及扩产,整体规模持续增加;同时,伴随韩厂产能的逐步退出,电视面板市场占有率进一步提升。根据群智咨询(Sigmaintell)预测数据,Top3面板厂商从出货数量和面积维度均实现市占进一步提升至60%以上。其中大尺寸的主流产品55"&65"市场份额超过75%,由此形成的高集中度为头部面板厂话语权增强和议价能力提升提供了保障。

供需及价格

供需及价格

LCD TV面板价格短期迎来超预期上涨。面板厂商积极控产带来的蝴蝶效应逐渐影响到整个电视产业链的策略变化,刺激部分电视整机厂商面板备货策略由保守转为激进。根据群智咨询(Sigmaintell)“供需模型”测算,2023年一季度全球LCD TV面板市场供需比明显回落到5.1%(面积基准),整体供需趋向平衡,预计二季度在面板供应跟随需求稳步恢复的前提下,供需比进一步回落到4.6%,供需趋于紧张。面板价格在面板厂扭亏激进策略的推动下,短期将迎来超预期的上涨,这包括价格上涨时间提前到2月份,以及接下来的中大尺寸面板价格涨幅将超预期。

虽然需求呈现弱恢复,但全球电视市场依然处于低谷期,产业链厂商应该理性对待面板价格上涨,避免因面板价格过快上涨对产业终端带来恶性影响。同时,面板厂也应持续推进理性和弹性控产,避免液晶电视面板价格再次剧烈波动给企业运营带来挑战。

英文:

LCD TV Panel prices ushered in an unexpected rise in the short term

Core topics:

Demand: end demand recovers weakly, panel strategy stocking demand strengthens

Supply: On-demand production and strong bargaining power are the main characteristics of the supply side in 23H1

S&D and Price: LCD TV Panel prices will usher in an unexpected rise in the short term

Entering 2023, the end demand for TV set market still maintains a "weak recovery,” but as the inventory in all processes of the TV supply chain becomes healthy, the confidence of set makers to stock up resumed; at the same time, on the supply side, the concentration of panel makers continues to increase, and panel makers have achieved a change in the S&D situation through continuous and active control of production. Sigmaintell believes that the global LCD TV panel market has fallen into a split situation of "half summer and half winter.” In 23H1, the S&D environment tends to be tense under the support of strategic stocking demand, which drives the short-term increase of LCD TV panel prices beyond expectations.

Demand: end demand recovers weakly, panel strategy stocking demand strengthens

In 2023, affected by the macro environment, the end demand for global TV market shows a weak recovery trend, but there are growth opportunities for demand in some regions. The inventory pressure in the North American channel has eased, and channel purchases have returned to normal. With the support of economic and cost factors, it is expected to bring about scale growth and structural optimization; the Southeast Asian market economy is improving, which will be an important support for the global TV market; TV Demand in other regions is still weak, but overall, global TV demand is expected to usher in a weak recovery.

After going through a deep destocking cycle, the inventory pressure in the industry chain has eased. After more than half a year of in-depth destocking cycles from channels and brands, channel inventories in major global regions and panel inventories of major TV brands have become healthy after the Spring Festival. At the same time, through active capacity control, the panel maker's own inventory has also been reduced to a relatively healthy level. According to Sigmaintell’s datas, as of the beginning of 2023, the overall inventory level of brands has dropped to 11 weeks, a healthy level; the overall inventory of LCD TV panel makers has also dropped to a relatively healthy level of 1.7 weeks. In 23H1, the inventory of panel makers is expected to achieve dynamic health in the adjustment of demand and production capacity.

Under the price increases expectation, Chinese makers’ strategic stocking demand is stronger, while global brands’ stocking demand remains conservative. Global brands and Chinese makers are diverging at the procurement strategy level. Global brands lack confidence in the demand of the end market. The procurement demand in 23Q1 remained conservative, and the procurement volume decreased by more than 20% YoY. Chinese brands are more sensitive to the panel price cycle. After the Spring Festival, under the expectation of rising prices of LCD TV panels, Chinese brands began to stock up on bottoms. However, under the expectation that it is difficult to expect a strong recovery in end demand, we must be vigilant that such a forward pace of stocking may overdraft panel procurement demand in 23H2, resulting in fluctuations in S&D and prices due to weakening demand.

According to Sigmaintell’s statistics, the global Top9 brands purchased 36.4 Mpcs panels in 23Q1. Driven by the strategic stocking up of Chinese brands, the purchase plan has increased by 2.2 Mpcs compared with the purchase plan before the Spring Festival holiday. In the short term, the stocking demand for LCD TVs panel is strong.

Supply: On-demand production and strong bargaining power are the main characteristics of the supply side in 23H1

The phased production control makes the inventory burden no longer the core element of the strategy of the panel maker. The further improvement of the supply concentration provides a basis for the strong implementation of the panel maker's turnaround strategy. UT: Mainland makers are practicing "on-demand production and dynamic production control,” Taiwanese makers are prudently recovering production capacity, and Korean makers' production capacity remains low. According to Sigmaintell’s research data, panel makers have actively reduced production since 22Q3. The overall UT in 23Q1 remained at a low level of 71%. Supported by the strong recovery in procurement demand from set makers, it is expected that the UT of G6 and higher LCD panel production lines will gradually recover to a level close to 80% in 23Q2.

Mainland panel makers implement the strategy of "on-demand production, dynamic production control.” In order to achieve the goal of a turnaround plan as soon as possible and reverse the situation of excess S&D, Mainland panel makers adhere to the strategy of "production on demand and dynamic production control.” Among them, production control was the most obvious during the Spring Festival in January, and the glass input increased significantly from February to March as the stocking demand resumed. Overall, Mainland panel makers are still implementing the strategy of "on-demand production and dynamic production control.”

The UT of Taiwanese makers has recovered cautiously. AUO took the lead in launching a substantial production reduction in 2022, and the recovery of production capacity was slow. However, as the inventory pressure eased and the demand for brand stocking resumed, the production capacity of the G8.5 gradually recovered, but the G6~G7.5 remained under control. Innolux's production reduction is mainly concentrated on the G7.5. With the strong demand from Chinese customers, its UT has also returned to a relatively high level.

The production capacity of Korean makers remains low. Affected by high costs and low prices, Korean makers have basically withdrawn from the supply of LCD TV panels. Only LGD retains a G8.5 in Guangzhou. The current plan is to maintain a low UT of about 50% for a long time.

According to Sigmaintell’s data, under the influence of panel makers’ control of production and the withdrawal of Korean makers’ production capacity, the global LCD TV panel supply area in 23Q1 dropped by 18.7% YoY, and panel makers are still in a state of production control. In 23Q2, under the support of panel demand, the panel supply area decreased by 1.7% YoY and increased by 15.8% QoQ.

Concentration: Top 3 panel makers have a market share of over 70% in mainstream sizes, further enhancing their bargaining power.

In recent years, Mainland panel makers have continued to increase their scale through M&A and production expansion. At the same time, with the gradual withdrawal of the production capacity of Korean makers, the market share of TV panels has further increased. According to Sigmaintell’s data, Top3 panel makers have further increased their market share to more than 60% in terms of shipment volume and area. Among them, the market share of large-size mainstream products 55" & 65" exceeds 75% shares, and the resulting high-concentration market provides a guarantee for the enhancement of the voice and bargaining power of the top panel maker.

S&D and Price

LCD TV panels price will usher in an unexpected rise in the short term. The butterfly effect brought about by panel makers' active production control has affected the strategic changes of the entire TV industry chain, stimulating some TV set makers' panel stocking strategies to change from conservative to radical. According to the Sigmaintell S&D model, the S&D ratio of the global LCD TV panel market will drop significantly to 5.1% (based on area) in 23Q1, and the overall S&D will tend to be balanced. Under the premise that panel supply will follow the steady recovery of demand, the S&D ratio will further fall to 4.6%, and the supply-demand tends to be tense. Driven by the aggressive strategy of panel makers to turnaround, panel prices will usher in an unexpected increase in the short term, including advancing the price increase time to February and the unexpected price increase of medium and large-size panels.

Although the demand has shown a weak recovery, the global TV market is still in a low period. Makers in the industry chain should treat panel price increases rationally and should avoid the adverse impact on industrial terminals due to the rapid rise of panel prices. At the same time, panel makers should continue to promote rational and flexible production control and avoid the business operation challenges brought about by the sharp fluctuations in LCD TV panel prices.