Core Topics:

Shipment volume: The overall panel market declined by 9.7% YoY, and it will be difficult to recover in 2023

Supply&demand and price: The market is still in a state of severe oversupply, but panel prices are expected to stop falling by the end of the year

Supply structure: The supply chain is facing "reconstruction and reshuffle,” and the market share ratio of mainland panel makers is increasing

Product structure: driven by "cost reduction and efficiency improvement,” there are good opportunities for structural upgrading

More than half of 2022 has passed. Looking back at the first half of the year, the global monitor panel market is in turmoil: at the beginning of the first quarter, consumer demand in the global monitor market has shrunk significantly, and commercial demand is also not recovering well, affected by the epidemic, the Russia and Ukraine conflict, and hyperinflation. As a result, the inventory of brands began to continue to rise. In the second half of the year, major brands are focusing on destocking, and the demand continues to decline, and the performance of major panel makers also shows significant differentiation. What is the outlook for market demand during market downturn? When will panel price stop falling and pick up? How is the supply structure evolving? All are worthy of in-depth thinking and exploration in the industry.

Shipment volume: The overall panel market declined by 9.7% YoY, and it will be difficult to recover in 2023

In 2022, the demand continues decline quarter by quarter. According to Sigmaintell research data, the global monitor panel shipments in 22Q1 were 46.1Mpcs, down 4.5% from the peak in 21Q4. As the epidemic, Russia-Ukraine conflict, and hyperinflation continue to intensify, the demand continues to decline, and the inventory of major brands continues to rise. Entering Q2, major brands have strictly managed their inventory, and panel shipments are only 42.2Mpcs, a decline of 8.5% QoQ. In the second half of the year, due to inventory pressure, major brands significantly reduced their panel purchasing volume. In Q3, the global monitor panel shipments were 33.5Mpcs, down 20.6% QoQ. This situation has not improved even as we enter the traditional peak purchasing season. Sigmaintell predicts that monitor panel shipments in Q4 will be 32.8Mpcs, a decline of 2.1% QoQ. The full-year shipment volume in 2022 will be 154.6Mpcs, down 9.7% YoY.

In 2023, demand is still difficult to recover. Affected by the constant spread of the Covid-19 pandemic, the turbulent geopolitical tensions, and the lack of improvement in hyperinflation, the monitor panel market will lack growth momentum next year. First, set demand lacks growth momentum. It is expected that oil prices will gradually fall next year but remains at historically high levels. Although North America, Latin America, and other regions with high energy self-sufficiency rates have a certain capacity to support demand. However, regions with low energy self-sufficiency rates, such as Europe, Asia-Pacific, and Africa, have limited ability to reduce inflation, which will continue to drag on market demand. Overall, the global monitor market in 2023 is expected to decline by 2.5% YoY. Secondly, under the strict destocking management strategy of major brands, it is expected that the inventory level of panel will gradually become healthy in 23H1. But given the bleak demand outlook, brands are expected to continue to tighten inventory management. Therefore, even though the rhythm of brand purchasing will gradually return to normal in 2023, purchasing demand for the whole year will remain conservative. Based on the above analysis, Sigmaintell predicts that global monitor panel shipments will be 153.7 Mpcs in 2023, a YoY decline of 0.6%.

Supply&demand and price: The market is still in a state of severe oversupply, and panel prices are expected to stop falling by the end of the year

Supply&demand and price: The market is still in a state of severe oversupply, and panel prices are expected to stop falling by the end of the year

In 2022, the global monitor panel market demand continue to decline, and the supply&demand ratio remain at a high level. In the first half of the year, major brands have successively reduced their panel purchases. However, the monitor capacity adjustment of major panel makers is limited, especially the top panel makers, whose capacity remains unchanged, and the market is in a state of severe oversupply. In the second half of the year, panel makers strengthened their efforts to control capacity. Based on area benchmarks, the actual capacity in September fell by 26% compared with January. However, the demand for major brands continued to decline, and the supply&demand ratio has not improved significantly. According to Sigmaintell's supply and demand model, as panel makers continue to revising down capacity, the supply&demand ratio gradually narrowed in Q4 but is still much higher than a healthy level.

Affected by the imbalance between supply and demand, panel prices have experienced a year-long decline since September last year. At present, almost all major products have fallen below the total cost, and low-end products have fallen below the cash cost. Panel makers are all facing severe operating pressure. To reduce loss and cash outflows, some panel makers have defined the price red line and implemented the strategy of "no orders below the price red line.” At the same time, after the active inventory management in the second and third quarters, the panel inventory of most brands returned to be healthy, and the panel purchasing demand in Q4 was structurally stable. In addition, the price of large-size TV panels has also gradually stabilized. Therefore, driven by the two tracks of supply and demand, low-end products’ current price has stabilized. The price decline of mainstream products and high-end products has continued to narrow. Based on the above analysis, Sigmaintell forecasts that the price of monitor panel is expected to stop falling by the end of the year. However, to further improve the relationship between supply and demand, panel makers still need to control capacity strictly. Next year, with the gradual demand recovery from top brands such as Dell, panel prices are expected to rebound slightly in 23Q2.

Supply structure: The supply chain is facing "reconstruction and reshuffle,” and the market share ratio of mainland panel makers is increasing

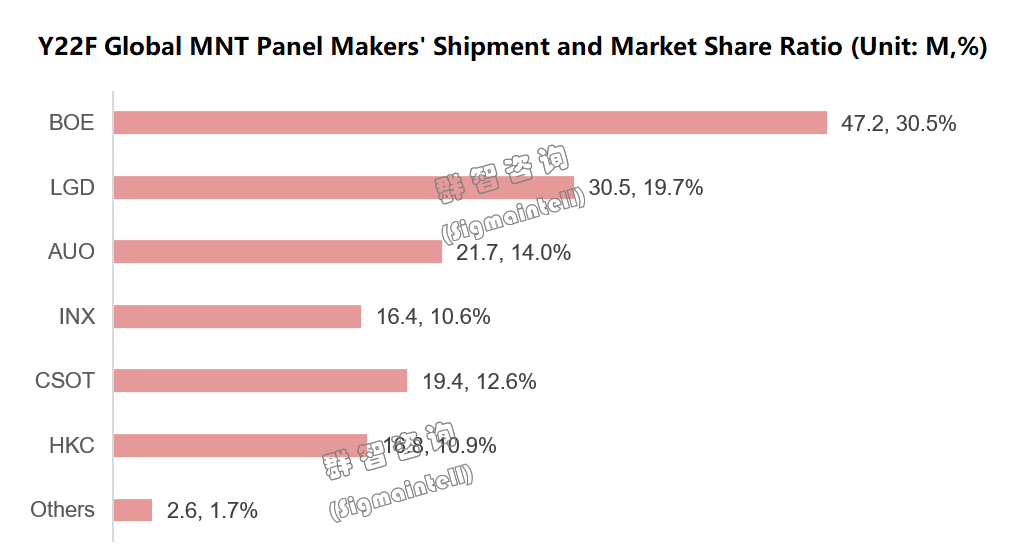

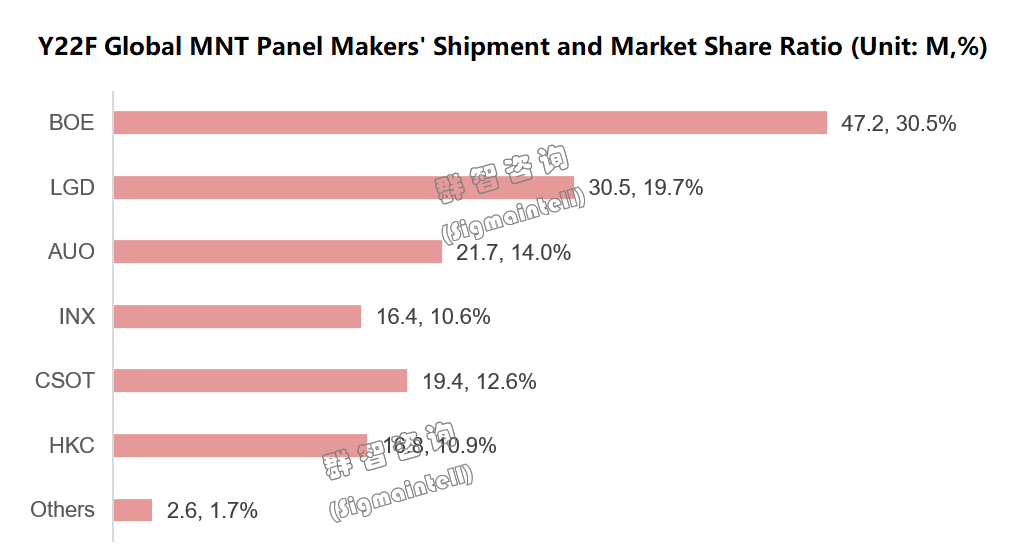

In the supply chain and market demand volatilities, the global monitor panel supply structure is facing reconstruction and reshuffle. According to Sigmaintell data, the global market share ratio of mainland panel makers will increase from 32.3% in 2019 to 55.5% in 2022. Among them, BOE increased steadily, and CSOT and HKC increased significantly. In contrast, the market share ratio of Korean and Taiwanese panel makers declined.

BOE, steady performance in the first half of 2022. In the second half of the year, the performance declined due to the continuous decline of the purchase of major brands. The total shipment in 2022 is estimated to be 47.2Mpcs, down 10.5% YoY, but the market share ratio is still 30.5%, ranking first.

CSOT, although the overall market fell significantly this year, CSOT performed brilliantly. With the transformation of commercial small-size TN to VA, its cooperation with leading brands such as Dell has continued to strengthen, and shipments in a single quarter have reached 5.5Mpcs. The total shipments in 2022 are estimated to reach 19.4Mpcs, a YoY increase of 34.0%, and its market share ratio has also increased from 8.5% last year to 12.6%. With the mass production of the new production line t9 in 23Q1, the product structure will be further improved, and the shipment volume will continue growing.

HKC, affected by the corporate strategy, HKC took an active shipping strategy. On the one hand, it strengthens the cooperative relationship with strategic customers. On the other hand, it also relies on the "reservoir" capability of the group's ODM plant. The total shipment in 2022 is estimated to reach 16.8Mpcs, a YoY increase of 41.7%, and the market share ratio has also actively increased to 10.9%. HKC and CSOT are the only two panel makers with YoY growth this year.

In terms of Taiwanese makers, the decline in 2022 is higher than the average level of the overall market. On the one hand, it is affected by the continuous downward of panel purchasing demand by major commercial brands. On the other hand, due to the impact of the cost pressure in its small generation line, combined with its product competitiveness position, it is facing great pressure this year. In 2022, AUO is expected to ship 21.7Mpcs, down 25.9% YoY, and its market share ratio will drop to 14.0%; Innolux is expected to ship 16.4Mpcs, down 18.9% YoY. Looking ahead to 2023, Taiwanese panel makers will face more uncertainty. With the mass production of CSOT t9, it is estimated that it will make continuous impact on Taiwan panel makers, and the shipment and market share ratio in 2023 may further decline.

In terms of Korean makers, in 2022, due to the continuous downward revision of core customer orders, LGD's shipment is expected to be 30.5Mpcs, down 19.1% YoY, and its market share ratio will drop to 19.7%. LGD is also facing uncertainty in 2023, mainly considering the production capacity growth of Chinese mainland and Taiwanese panel makers in IPS, and will compete fiercely for its IPS customer resources.

Sigmaintell predicts that the market share ratio of mainland panel makers will increase slightly to 57.3% in 2023, accounting for the dominant position in the global monitor panel supply. The changes in the supply structure are mixed with many factors such as product technology changes, generational line competition, and changes in brand supply chain strategies.

The G8.x line replaced the small generation as the main production line for monitor panels. High-generation lines in mainland have got opportunities, and Taiwanese panel makers are seeking transformation.

With the rapid growth of G10.5 capacity, LCD TV panel production has gradually shifted to G10.5, and the G8.5-8.6 line has shown an increasing trend in monitor supply. According to the Sigmaintell monitor panel capacity tracking database, G8.x will account for 81.5% of the global monitor panel capacity in 2022 based on area, making it the complete main production line. The G8.x capacity of Chinese mainland panel makers account for 72.3% in the G8.x supply market, with obvious capacity advantages. The advantages of G8.x compared to low-generation lines are mainly reflected in two aspects: on the one hand, the equipment has higher precision and can support a more diversified product portfolio. On the other hand, the cutting efficiency of mainstream specifications is more economical, which is more comprehensive, and the cost advantage is obvious. Therefore, Taiwanese panel makers are also actively seeking transformation by adjusting production capacity and technology mix to expand the proportion of monitor panels in the G8.x line.

Mid-end and low-end monitors have experienced technical iterations, VA accelerated penetration and squeezed the market of TN products, and VA high-end promotion was hindered.

Mid-end and low-end monitors have experienced technical iterations, VA accelerated penetration and squeezed the market of TN products, and VA high-end promotion was hindered.

While panel makers have expanded the monitor capacity investment in the G8.x line, they have also accelerated the replacement of TN by VA technology. Because VA can significantly improve the viewing angle of TN products, and VA has won the growth momentum based on low or even no price difference with TN. Therefore, under the influence of the long-term positive price strategy of VA panel makers, commercial low-end TN products are gradually replaced by VA products, and this trend will accelerate significantly in 2022. The leading brands have expanded the purchase volume of VA panels in the commercial low-end product line, which has also led to a significant increase in the supply of VA Monitor, mainly from Chinese mainland panel makers. But in the high-end market, VA lacks growth momentum. Since the beginning of 2021, SDC has gradually discontinued VA capacity, and some high-end VA markets have been filled by high-end IPS. In the future, VA makers will face pressure on how to improve product competitiveness in the high-end market.

The brand pursues a diversified supply chain strategy, and mainland panel makers seize the market share.

The brand pursues a diversified supply chain strategy, and mainland panel makers seize the market share.

During the tense supply chain period from 2020 to 2021, all brands face the challenge of adjusting supply chain strategies, which provides market opportunities for new panel makers in Chinese mainland. In the destocking cycle in 2022, new panel makers in Chinese mainland took prior aggressive price strategies to stabilize orders and expand market share. However, Korean makers, such as LGD display, have relatively concentrated customer structures and face higher supply risks during the customer inventory management period. The Taiwanese panel makers continued the "profit-oriented" strategy, and when the cost was under pressure, the shipments was significantly reduced. In terms of new product layouts, mainland panel makers are also significantly faster than competitors, such as new sizes, such as new specifications, high resolution, and high refresh rate products. Looking forward to the future, mainland panel makers, especially the late-comers, will take active strategy in product development, customer development, and price strategy with the mass production of new lines and capacity, which is expected to continue to promote changes in the market structure.

Looking forward to the next three years, the monitor capacity will continue to be transferred to the high-generation line, and the supply chain structure will continue to be "shuffled.”

According to the existing public production line investment plan, the capacity of high-generation line continues to expand. Among mainland panel makers, TCL CSOT t9 G8.6 plans to mass-produce MNT products in 23Q1. Tianma Xiamen G8.6 is expected to be mass-produced in 2024, focusing on MNT and NB products. IVO G8.6 is also under planning and is expected to be mass-produced from 2025 to 2026. In addition, in terms of Taiwanese panel makers, AUO's G8.5 generation line IPS transformation has been completed, and the capacity of G8.5 IPS monitor will further expanded by additional investments. Innolux G8.5 IPS capacity is steadily increasing. With the gradual release of the capacity of the high-generation line, it is expected that the competition for customer resources will continue to intensify in the next 3 to 5 years, and the panel supply structure will continue to be "shuffled.”

Driven by "cost reduction and efficiency improvement,” there are good opportunities for structural upgrading.

Under the market downturn and the intensified competition in the supply chain, major panel makers have actively adopted the development strategy of "reducing costs and increasing efficiency,” which also provides an opportunity for product structure upgrades. Firstly, due to upstream material bargaining, accelerated introduction of localized materials, and efficiency improvements in panel makers, the cost of mid-to-high-end products has continued to improve, narrowing the cost difference with mainstream products. Secondly, panel makers and set makers are actively investing in the development of mid-to-high-end products, such as QHD and UHD high-resolution products, and 165Hz, 200Hz, and 240Hz high-refresh ratio products, which will continue to promote the accelerated penetration of mid-to-high-end technologies into the mainstream market.

中文部分:

显示器面板市场格局面临“重建和洗牌”——2022全球显示器面板市场总结及展望

核心观点:

出货规模:2022年大盘下滑9.7%,2023年将难以回暖

供需及价格:市场仍处于严重的供大于求状态,面板价格有望年底触底

供应格局:供应链正面临“重建和洗牌”,大陆厂商供应比重增长

产品结构:“降本增效”推动下,结构升级迎契机

2022年已过大半,回顾本年度,全球显示器面板市场动荡加剧:一季度伊始,因疫情、俄乌冲突、超级通胀影响,全球显示器市场消费需求明显萎缩,商用需求亦复苏不利,各品牌库存开始持续走高。整个下半年,各大品牌均以去化库存为主旋律,显示器面板需求持续走低,各大面板厂表现也呈现明显分化。在市场下行期,市场需求前景如何?面板价格何时触底,何时回暖?显示器供应格局如何演变?均值得行业深度思考与探寻。

出货规模:2022年大盘下滑9.7%,2023年将难以回暖

2022,需求逐季下滑。根据群智咨询(Sigmaintell)调研数据,2022年一季度全球显示器面板(Monitor Panel)出货量为46.1Mpcs,较2021年四季度高峰值下降4.5%;随着疫情、俄乌冲突、超级通胀持续加剧,全球显示器市场需求持续走低,各大品牌库存持续走高,进入第二季度,各大品牌均严格管理库存,面板出货仅有42.2Mpcs,环比下滑8.5%。进入下半年,因库存压力,主力品牌大幅下修面板采购需求。三季度全球显示器面板出货33.5Mpcs,环比下滑20.6%。即使进入传统采购旺季,这一情况仍未得到改善。群智咨询(Sigmaintell)预测,四季度显示器面板出货32.8Mpcs,环比继续下滑2.1%。2022年全年出货规模预计为154.6Mpcs,同比下降9.7%。

2023,需求仍难以回暖。在疫情持续反复、国际形势持续动荡、超级通胀仍未见明显好转等因素影响下,明年显示器面板市场缺乏增长动力。首先,终端需求缺乏增长动力。可以预见,明年原油价格将逐渐回落但仍处于历史高位,虽北美、拉美等能源自给率较高的地区,存在一定的需求托底能力,但欧洲、亚太、非洲等能源自给率较低的地区降通胀的能力有限,将持续对市场需求形成拖累。整体来看,2023全球显示器整机市场预估同比下滑2.5%。其次,在各大品牌严格的去库存化管理策略下,尽管预计显示器面板库存水位在明年上半年将逐渐走向健康,但考虑到需求前景黯淡,品牌预计将持续加严库存管理。因此,即使2023年品牌采购节奏将逐渐恢复正常,但全年采购需求仍呈保守状态。结合以上分析,群智咨询(Sigmaintell)预测,2023年全球显示器面板预计出货153.7Mpcs,同比仍下滑0.6%。

供需及价格:市场仍处于严重的供大于求状态,面板价格有望年底触底

2022年全球显示器面板市场需求持续下滑,供需比例一直居于高位。上半年,各大品牌陆续下修面板采购规模,但各大面板厂显示器产能调整有限,尤其是头部面板厂,其产能基本维持不变,显示器市场处于严重供大于求状态。 进入下半年,面板厂加大了控产力度,以面积基准测算,9月实际产能相较于1月,下滑26%。但主力品牌需求仍持续下滑,供需关系仍未见明显改善。根据群智咨询(Sigmaintell)供需模型测算,随着面板厂控产力度加大,四季度供需比逐渐收窄,但仍远高于健康水位。

受供需失衡的影响,显示器面板价格自去年9月经历了长达一年的下跌,当前几乎所有主力规格全部跌破总成本,低端规格产品已跌破现金成本,各大面板厂面临严峻的经营压力。为减少亏损和现金流出,部分面板厂已明确价格红线,实行“低于价格红线不接单”策略。同时,在经历过二、三季度的积极库存去化管理后,部分品牌的面板库存回落到健康状态,四季度的面板采购需求呈结构性稳定状态。此外,大尺寸TV面板价格也开始逐步企稳。因此,在供需两股赛道同时拉动下,当前低端产品价格基本趋于稳定,主流产品及高阶产品价格降幅持续收窄。综合以上分析,群智咨询(Sigmaintell)认为,显示器面板价格有望年底全部止跌,但为进一步改善供需关系,面板厂仍需严格控产。明年随着Dell等头部品牌需求逐渐恢复,面板价格预计在明年二季度开始微幅回弹。

供应格局:供应链正面临“重建和洗牌”,大陆厂商供应比重增长

在供应链和市场需求大幅波动的过程中,全球显示器面板供应格局也正在重建和洗牌过程中。群智咨询(Sigmaintell)数据显示,中国大陆面板厂商的全球市场份额从2019年的32.3%增长到2022年的55.5%。其中,京东方的份额稳定增长,TCL华星和惠科的份额显著增长。相应的,韩系和中国台湾厂商份额下降。

京东方(BOE),2022年上半年表现稳健,下半年由于主力品牌持续下修采购规模,表现有所下滑,全年出货规模预估47.2Mpcs,同比下滑10.5%,但市占率仍达30.5%,稳居第一。

TCL华星(CSOT),尽管本年度大盘滑落明显,但TCL华星表现亮眼。随着商用小尺寸TN向VA转型,其与Dell等头部品牌合作持续加强,单季度出货达到5.5Mpcs,全年出货总量达19.4Mpcs,同比增长34.0%,其市占率也由去年8.5%提升至12.6%。随着明年一季度新产线t9量产,其产品形态与产品结构将进一步得到完善,出货规模仍将持续增长。

惠科(HKC),受集团战略影响,惠科在显示器面板采取积极的出货策略,一方面强化与核心客户的合作关系,另一方面也依托于集团显示器制造工厂的“蓄水池”能力,2022年全年出货预估达16.8Mpcs,同比增长41.7%,市占率亦积极提升至10.9%,其与CSOT为今年同比增长仅有的两家面板厂。

台厂方面,2022年下滑幅度高于大盘平均水平。一方面有受到商用主力品牌持续下修面板采购需求的影响,另一方面由于自身小世代线成本压力影响,再叠加自身产品竞争力定位,本年度面临较大的出货压力。2022年,友达(AUO)预估出货21.7Mpcs,同比下滑25.9%,市占下滑至14.0%;群创(INX)预估出货16.4Mpcs,同比下滑18.9%。展望2023年,台厂面临较多的不确定性。整体来看,随着CSOT t9量产,预估对台厂产生持续冲击,2023全年出货规模和市场份额将可能进一步下滑。

韩厂方面,2022年,因核心客户订单持续下修,LG显示(LGD)出货规模预计30.5Mpcs,同比下滑19.1%,市占下滑至19.7%。2023年同样面临着不确定性,主要考虑中国大陆及台湾厂商在IPS上的产能增长,将对IPS客户资源展开激烈竞争。

群智咨询(Sigmaintell)预测,2023年中国大陆面板厂的全球份额还将小幅增长至57.3%,稳居全球显示器面板供应的主导地位。供应格局变化的背后交织着产品技术更迭、世代线竞争、品牌供应链策略变化等多重因素的变化。

G8.x产线取代小世代成为显示器面板主力产线,中国大陆高世代产线迎契机,台厂谋转型。

随着全球10.5代产能的迅速增长,LCD TV面板的生产重心逐渐转移到G10.5代,8.5~8.6代产线对显示器供应分配呈增加趋势,群智咨询(Sigmaintell)显示器面板产能追踪数据库显示,2022年全球显示器面板产能投片面积中,G8.x占比为81.5%,成为绝对的主力产线。而中国大陆厂商在G8.x显示器面板供应市场中份额高达72.3%,产能优势明显。G8.x相较于低世代线的优势主要体现在两个方面:一方面产线设备精度更高,可支持更多元化的产品组合;另一方面主流规格切割效率更经济,经济效率产品线更广,成本优势明显。因此,台厂也积极谋求转型,通过调整产能和技术组合,扩大在G8.x产线中显示器面板的比重。

Monitor 中低端迎技术迭代,VA加速渗透挤压TN产品份额,VA高端提升受阻。

面板厂商在G8.x产线扩大显示器产能投入的同时,也加速了VA技术对TN的替代速度。因VA可明显改善TN产品可视角问题,在价差低甚至无价差的基础上,VA赢得增长动力。因此在VA厂商长期积极的价格策略影响下,商用中低端TN产品逐渐被VA产品替代,这一趋势在2022年明显加速,主力品牌在商用低端产品线扩大VA采购规模,因此也带动以中国大陆厂商为主的VA Monitor供应规模增长明显。但在高端市场,VA发展遭遇阻力。随着2021年初以来SDC逐渐停产VA产能,一些VA高端市场被IPS高端填补,未来VA面临在显示器高端市场如何提升产品竞争力的压力。

品牌追求多元化供应链策略,大陆新进面板厂顺势抢占市场份额。

在2020~2021年的供应链紧张期,各品牌均面临供应链策略调整的挑战,这给中国大陆新进面板厂提供了市场契机。而在2022年的去库存周期中,大陆新进面板厂商率先采取激进的价格策略稳固订单和扩大市场份额。而韩厂LGD显示器客户结构相对集中,在客户库存管理期所面临的供应风险较高;台厂延续“利润导向”策略,在成本承压时,出货规模明显减少。其次,在新品布局方面,无论是新尺寸、新规格,还是在高分高刷等产品线布局,大陆面板厂布局速度明显快于竞争对手。展望未来,大陆厂商尤其是后进厂商伴随着新线落地与产能爬坡压力,不管是在产品研发、客户开拓还是价格策略上均采取积极举措,预计仍将推动着市场格局变化。

展望未来3年,产能将持续转移至高世代线,供应链格局持续“洗牌”。根据现有公开产线投资计划,大世代线显示器产能持续扩张。大陆面板中,TCL华星 t9 G8.6计划明年一季度初量产MNT产品;天马(Tianma)厦门G8.6预计2024年量产,主营MNT和NB产品。龙腾(IVO) G8.6亦在规划中,预计2025~2026量产。其次,台厂方面,友达G8.5代线IPS改造完成,扩充G8.5 IPS显示器产能;群创G8.5 IPS产能稳步提升中。可以预计,未来3~5年,随着大世代线产能逐渐释放,客户资源争夺将持续加剧,面板供应格局也将持续“洗牌”。

“降本增效”推动下,结构升级迎契机。在市场低谷与供应链竞争加剧两大因素叠加下,各大面板厂商均积极采取“降本增效”的发展策略,也为产品结构升级提供了契机。首先,从上游材料议价、国产化材料加速导入,到面板厂内效率提升,中高阶产品成本持续得到改善,缩小了与主流产品的成本差异。其次,面板厂和整机厂均积极投入中高阶产品开发,QHD、UHD高分产品,165Hz、200Hz、240Hz等高刷产品规划积极,将持续推动中高阶技术加速向主流市场的渗透。