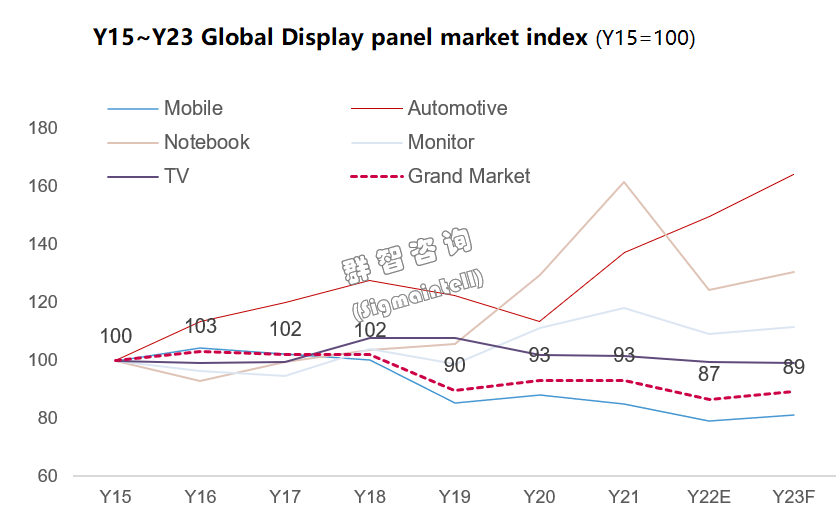

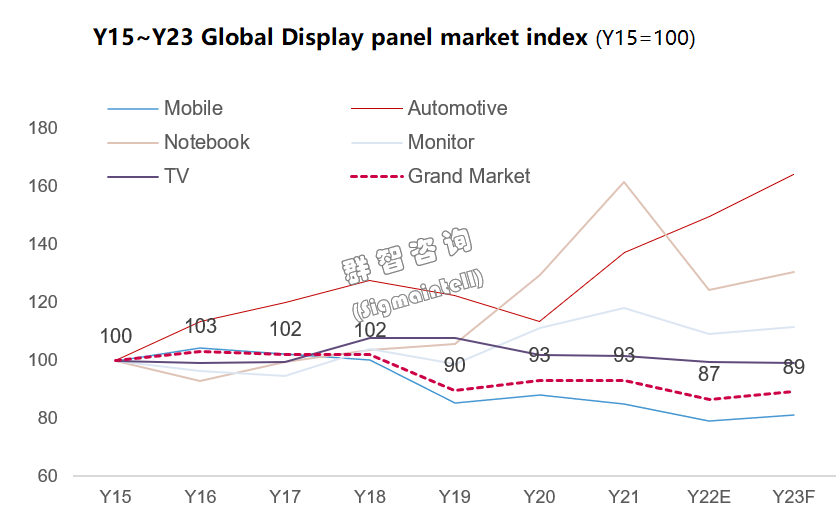

1. The market index in 2022 has dropped below the level in 2015 and will rebound slightly in 2023. The overall market will recover completely in 2025.

Since 2022, with the advent of the post-epidemic period, market demand in major regions has declined rationally, and key consumer electronics, including smartphone, Notebook PC, Monitor, and TV, have met different degrees of decline in shipments. According to Sigmaintell Index, 2022global key consumer electronics market index fell back to 97 in 2022, lower than 2015 (based on 100). The smart phone and TV market indexes were 92, while the Notebook PC and Monitor market indexes were 138 and 111, still higher than that period in history.

Affecting by the destocking cycle, the panel market index shows more significant fluctuation. 2022Global display market index is expected to fall back to 87 (based on 100 in Y15) in 2022, especially smart phones and tablets. But the market indexes of new energy and hybrid work application represented by automotives, and notebooks remained at a high level of 150 and 128. The reason is as follows: The “mobile Internet” era started in 2010 and reached its peak in 2015, bringing smartphones into the stock replacement cycle. The "Covid-19" and "carbon neutrality" that began in 2020 are accelerating the penetration of “EV” and "hybrid work,” which has driven relevant market indexes to show different performances. In the short term, the epidemic premium from 2020 to 2021 led the overall large-size market to peak in 2021. And the post-epidemic period from 2022 to 2024, the overall demand for large-size panels will gradually decline at a high level. But according to Sigmaintell’s forecast, a new round of replace demand will be replaced by 2025. Specifically, by 2023, the overall demand will recover slightly, but the recovery will be weak. Especially, notebook panel and automotive panel shipments are expected to grow.

2. Capacity supply: The utilization rate is generally adjusted, and the total production area of large-size LCD panels in 22H2 will decrease by more than 30% YoY

2. Capacity supply: The utilization rate is generally adjusted, and the total production area of large-size LCD panels in 22H2 will decrease by more than 30% YoY

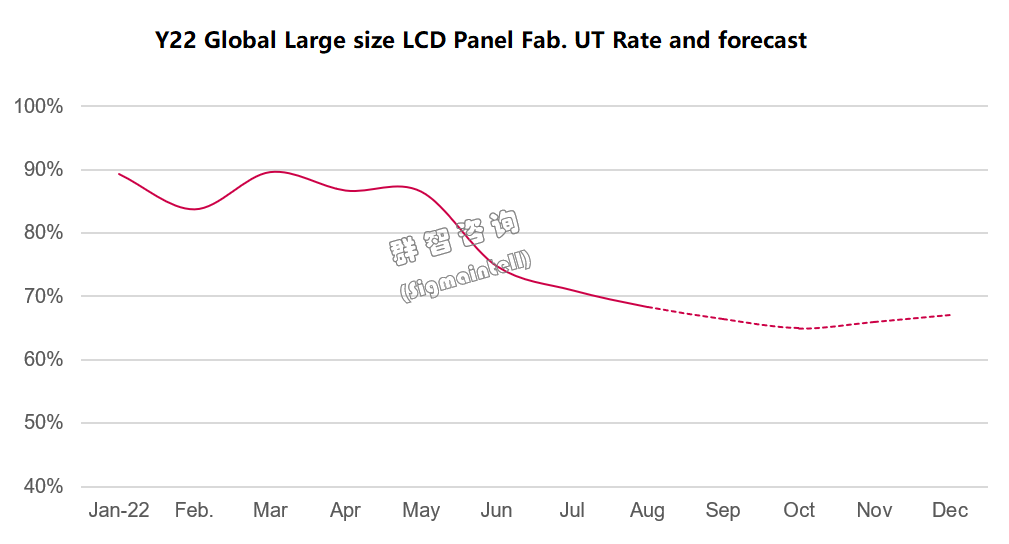

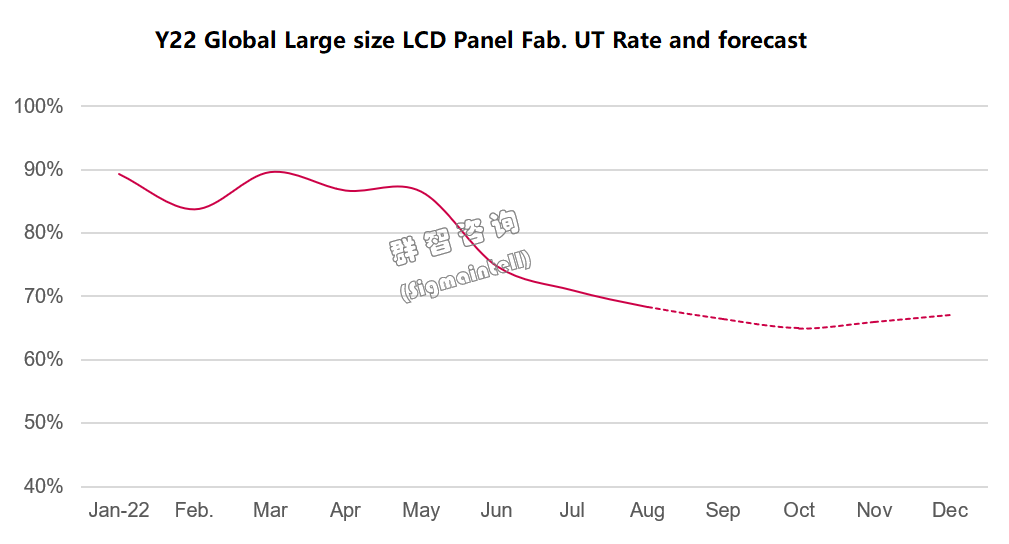

To answer the impact of weak short-term demand and deep destocking of the supply chain, the utilization rates of major global panel makers have been adjusted to different degrees. Entering Q3 and Q4, as the price of key panels fell below the cash cost, panel makers would like to further decrease utilization rate.. In 22Q3, global display panels' overall capacity utilization rate fell below 70%. Taking BOE as an example, it has further dereased the glass input level in G8.5 and G10.5, and the high-generation production utilization rate has reached about 70%. Innolux also further decreased the utilization rate of its key production lines, and its overall utilization rate fell to 59%. In terms of applications, the utilization rate of notebook panel production lines is expected to reach a historic low of about 60% in 22H2, and the TV panel capacity utilization rate will also drop by about 30%. From a long-term perspective, panel makers, especially those in mainland China, are also significantly slowing down their investment in new LCD capacity.

In 22H2, the panel industry will be in the most severe trough of the industry cycle in history. According to Sigmaintell's forecast, panel makers will continue to further reduce glass input. At present, only control utilization can help alleviate the oversupply and slow down or even promote panel prices to stop falling. In the context of the continued expansion of losses, when capacity can be recovered in 2023 will depend on the recovery of demand and time to alleviate supply and demand.

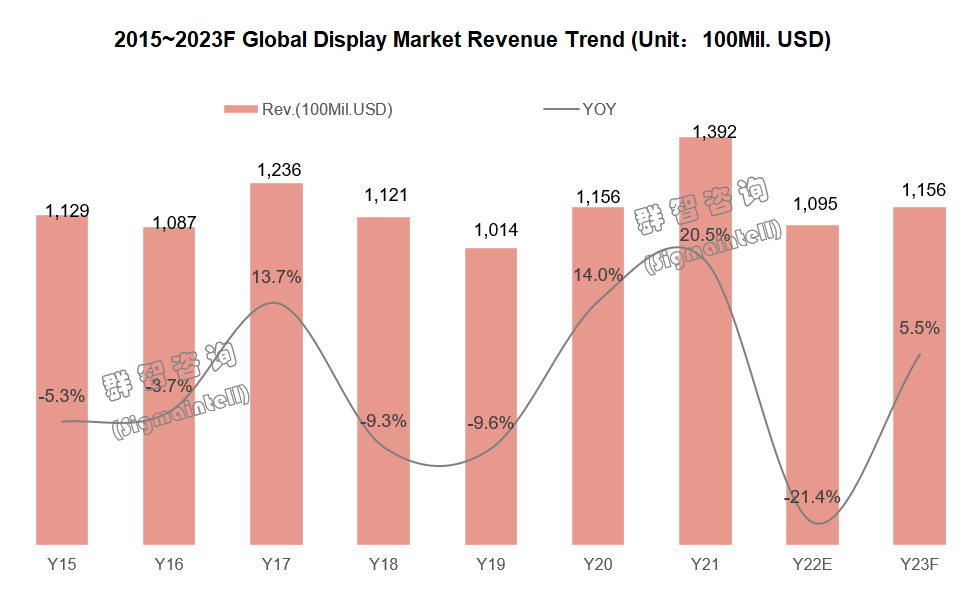

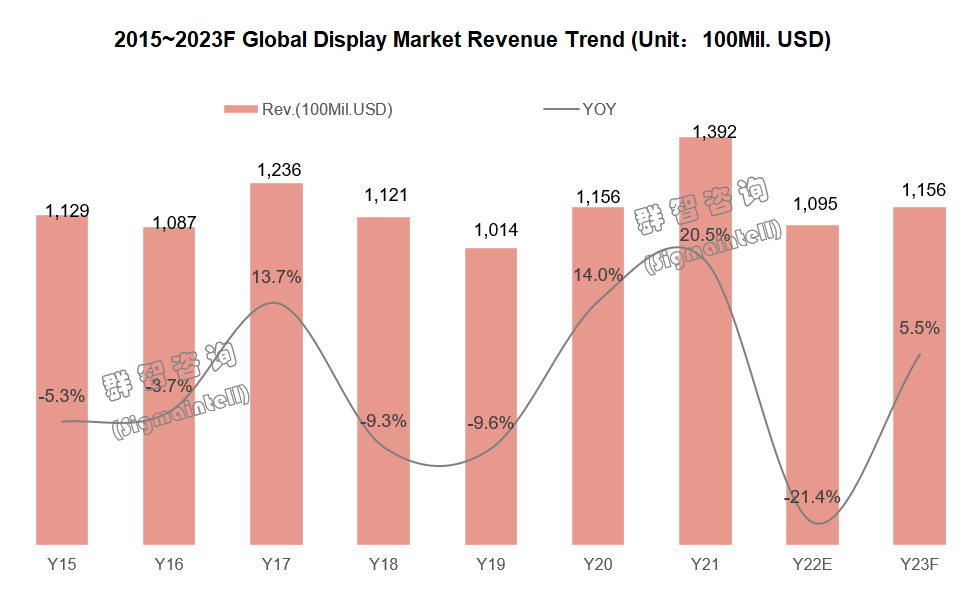

3. Revenue: In 2022, global display panels revenue will experience the most significant fluctuation in 10 years, and it is expected to rebound slightly in 2023

3. Revenue: In 2022, global display panels revenue will experience the most significant fluctuation in 10 years, and it is expected to rebound slightly in 2023

In 2021, the epidemic premium will drive the overall panel revenue to achieve a year-on-year growth of 20.5%. However, in 2022, the panel price fell uncontrollably, which caused all the previous year’s growth to fall back, and even the absolute price was lower than the 2020 level. According to Sigmaintell’s forecast, the global display panel revenue will drop by 21.4% in 2022. In the face of such substantial short-term fluctuations, Sigmaintell believes it is essential to maintain the stable development of the overall industry. In future development, how to avoid excessive fluctuations in panel supply and demand and prices is the direction that the panel industry chain should work together.

According to Sigmaintell forecast, there will be a slight increase of about 5.5% in panel revenue in 2023. On the one hand, the main drivers will come from the growing demand for notebooks and automotive panels; on the other hand, under the premise that panel makers continue to control capacity, the output value of TV panels is also expected to increase slightly in 2023.

4. Large-size market: the "Matthew effect" reappears; the big become bigger, and the strong become stronger

In 2022, from the perspective of the large-sized panel market (notebook, monitor, and TV), various panel makers' strategies and market performance will be differentiated. The head makers will perform steadily, the waist makers will move forward aggressively, and the performance of small and medium panel makers will be lower than expected. The market reappears the "Matthew effect.”

According to Sigmaintell’s survey data, the shipment share of the top five panel makers in the global large-size panel market will increase from 76% in 2020 to 81% in 2022. Among them, the market share of mainland China maker BOE maintained steady growth; CSOT showed a positive growth trend in market share driven by aggressive capacity expansion and market strategy; HKC ranked third in the TV application. However, as a latecomer to the panel, its competitiveness in the overall IT application field is relatively weak: shipments in the notebook field declined Y-o-Y, and the decline in demand also suppressed the growth in shipments in the monitor field; Taiwan China panel makers are relatively conservative in terms of overall market strategy and capacity investment. In the context that the scale advantage of the overall large-size panel market is gradually weakening, Taiwan China makers will choose product segmentation or high-end positioning in the future. Korean makers decided to gradually withdraw from the LCD field and make efforts in the OLED field. LGD continues to increase the proportion of OLED in TV application panel shipments; SDC OLED Notebook, monitor, and TV panel shipments will also show a gradual growth trend in the future.

5. OLED investment: Panel makers will invest in high-generation OLED production lines and promote technological diversification

In 2022, LCD panel capacity has changed from rising to falling, and OLED panel production capacity continued to grow. Overall, the OLED production line's investment direction will significantly change. On the one hand, it will be transferred from the low-generation line to the high-generation line. On the other hand, it will show the characteristics of technological diversification.

From the perspective of the global capacity pattern, Chinese Mainland panel makers have an absolute competitive advantage in the LCD field, with capacity accounting for more than 70%. However, the OLED field is still dominated by two Korean makers. Especially, SDC maintains a leading edge in the small-size field, and its investment in high-generation panel production lines is also accelerating especially the G8.5 generation line. The overall proportion of the panel field will remain at around 70%. Although Chinese Mainland panel makers are also actively catching up, there is still a gap in the short term compared with Korean makers.

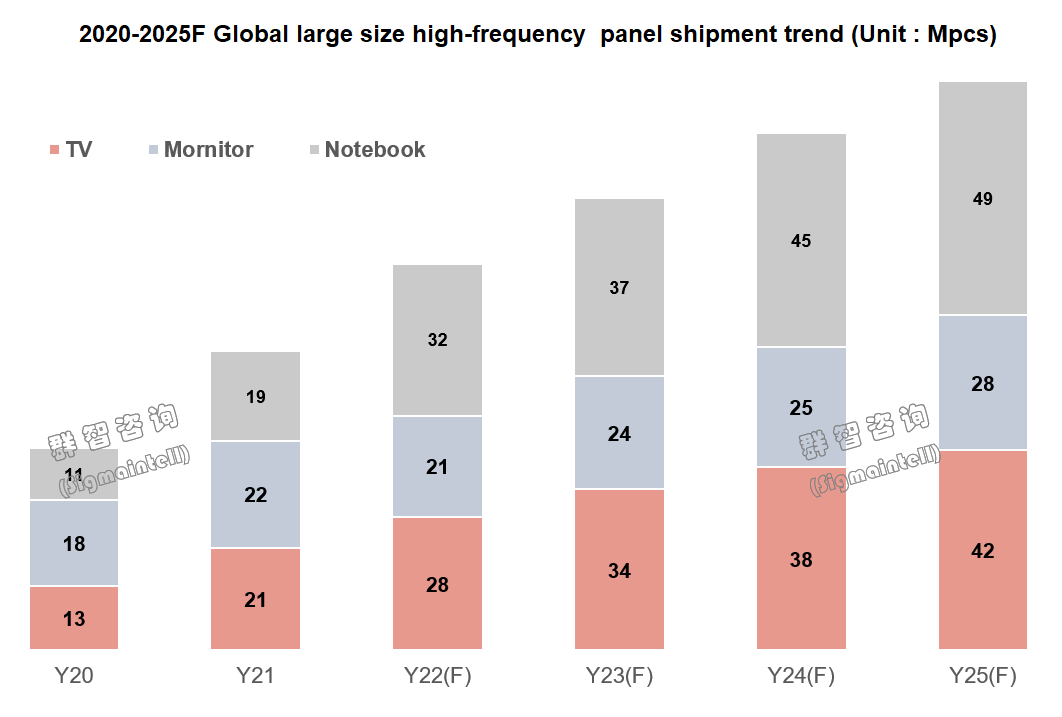

6. High-frequency panel shipment will grow steadily; foldable smartphone demand will keep a considerable growth

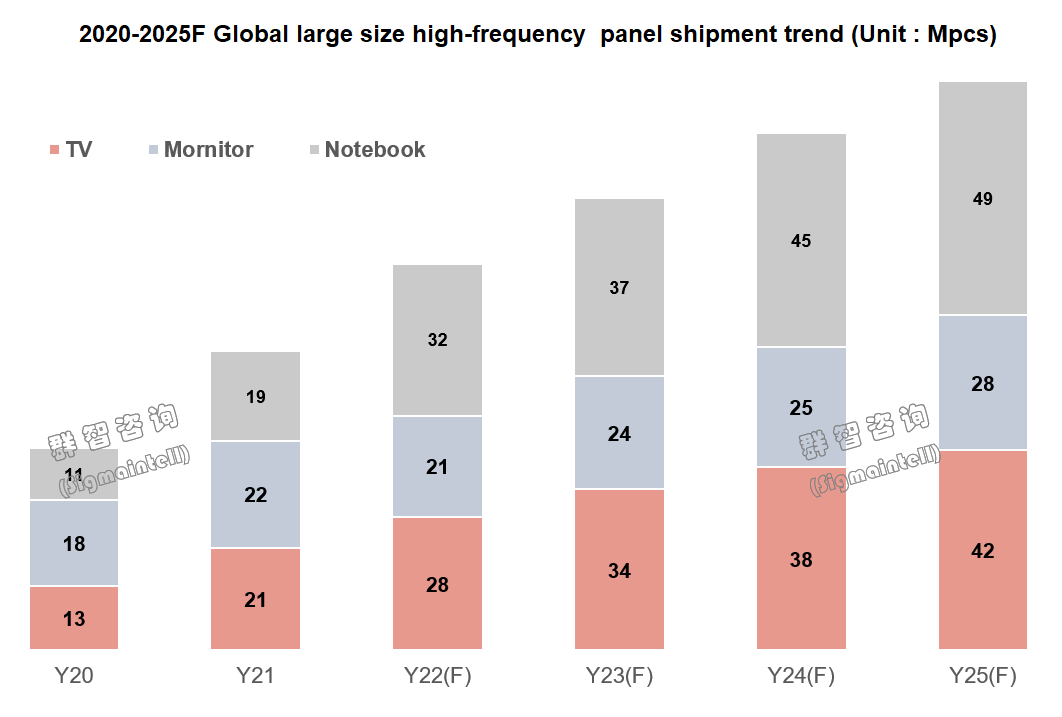

According to Sigmaintell's survey data on global consumer habits, high-frequency has become an important direction to meet consumers' needs for upgrading products with entertainment attributes and office attributes. High-frequency display products also significantly improve the user experience. In addition, global panel makers and set brands actively carry out product layouts. Sigmaintell forecasts that there will be expected growth in the next few years for high-frequency products, whether in TV, monitor, or notebook fields.

In terms of small size, smartphones have entered the stock market, and the replace demand is insufficient. But foldable phones are emerging as the new growth driver. Driven by the active layout and strategies of major global smart phone brands, the demand for foldable phones is expected to grow rapidly. According to Sigmaintell’s forecast, the global shipment of foldable phones is expected to exceed 50 million units by 2025.

7. Panel makers should reduce costs and increase efficiency, identify their positioning, and improve their ability to cope with industry winter (downturns)

In the context of industry downturns, Sigmaintell believes that, on the one hand, panel makers should actively promote the cost and improve efficiency to reduce operating costs as much as possible.

From the analysis of the profitability of each panel maker, CEC-Panda, LGD, AUO, Innolux, and JDI all suffered considerable losses in Y19. However, after experiencing the decline cycle in 2019, The Taiwan China panel makers have made many costs cut measures, including continuous optimization of capacity and product structure. At present, the Taiwan China panel maker has established relative competitiveness in terms of cost, technology, and product portfolio.

On the other hand, Sigmaintell believes that panel makers with a strong ability to resist cyclical fluctuation risks are divided into two camps, one is big and comprehensive, and the other is small and professional.

The big and comprehensive representative is BOE. BOE's overall profitability and competitiveness have been strengthened by relying on its scale competitiveness and multi-category synergistic development advantages. Even though the shipment area of its TV panels accounts for 66% of its internal share, it only accounts for 25% of its revenue. At the same time, applications such as mobile phones, notebooks, and monitors have a balanced share. Therefore, even if the single TV market has poor demand, declining value, and low profitability, BOE can still resist the decline through the synergy between multiple categories.

The small and professional representative is SDC. SDC mainly focuses on the OLED field. The performance of SDC's operating income and profit margin is very strong due to its deep research into the technology and product competitiveness of the OLED field. Although the proportion of SDC TV panel shipments is still high this year, it only accounts for about 5% of its revenue. Its main profits come from small-sized OLED products, and SDC maintains an absolute advantage in the field of small-sized OLEDs.

In the current cold winter of the overall panel industry, companies should no longer rely on pure price competition to increase their share. Based on their conditions, they should identify their positioning and build competitiveness that meets their conditions to improve their ability to resist the winter.

中文:

全球显示产业七大趋势

1.2022年市场指数跌至低于2015年水平,2023年将小幅回暖,整体市场预计2025年全面复苏

2022年以来,随着后疫情期来临,各大区域市场需求开始理性回落,包括智能手机、Notebook PC、 Monitor以及TV在内的消费电子主流应用都呈现不同程度的出货下滑。从群智咨询市场指数(Sigmaintell Index)来看,2022年整体消费电子市场指数回落到97,比2015年更低的水平(以2015年基数为100)。其中,智能手机和TV市场指数均为92,而笔记本电脑(Notebook PC)和显示器(Monitor)市场指数为138和111,仍高于历史同期水平。

受到去库存周期的影响,面板市场指数的波动更为显著,预计2022年全球主流应用面板市场指数回落到87(以2015年基数为100),其中尤以智能手机和平板电脑回落较为明显,而以车载、笔记本电脑为代表的新能源和混合办公模式的新场景应用的市场指数分别维持在150和128的较高水平。究其原因,始于2010年的“移动互联网”时代在2015年达到高峰后,使得智能手机进入了存量替换市场。而始于2020年的“新冠疫情”和“碳中和”行动,正在加速“新能源汽车“和“混合办公模式”的渗透,进而推动相关市场指数呈现不同表现。短期来看2020~2021年的疫情红利带动整个大尺寸市场规模在2021年达到高峰;而2022~2024年的“后疫情期”,大尺寸应用面板的整体需求将在高位呈现逐步回落态势;但群智咨询(Sigmaintell)预计,到2025年将迎来新一轮换机需求。具体到2023年来看,整体需求将有小幅恢复,但恢复力度较弱;然而Notebook面板和车载面板出货预计将获得增长。

2. 产能供应:普调稼动率,2022年下半年大尺寸LCD面板总投产面积将同比减少超30%

为应对短期需求疲软和供应链深度去库存影响,全球主要面板厂商稼动率有不同幅度的调整。进入三四季度,随着主流面板价格下降至现金成本以下,面板厂商纷纷加大减产力度,2022年三季度,全球显示面板的整体产能稼动率跌破70%。以京东方(BOE)为例,其加大了G8.5和G10.5等高世代线的减产力度,高世代稼动率来到70%左右。群创也进一步扩大主力产线的减产幅度,其总体稼动率降至59%。分应用来看,预计2022年下半年Notebook面板产线稼动率将来到历史性的低位60%左右,TV面板产能稼动率也下降约30%。而从长期策略来看,面板厂商尤其是中国大陆面板厂商对于LCD新产能的投资力度也在明显放缓。

2022年下半年,面板行业将处于史上最严峻的周期低谷中,群智咨询(Sigmaintell)预计,面板厂商还将继续扩大减产幅度,当前也唯有继续减产才能有利于缓和供过于求的供需关系,减缓和推动面板价格止跌。在亏损持续扩大的背景下,2023年何时能恢复产能将取决于需求恢复以及供需关系的缓解时间。

3. 产值:2022年显示面板产值将遭遇10年来最大波动,预计2023年将小幅回升

2021年,疫情红利带动整个面板产值实现了20.5%的同比增长。但2022年面板价格失速下跌,上一年的涨幅全部跌回,甚至绝对价格已低于2020年水平。群智咨询(Sigmaintell)预测,2022年全球显示面板产值将下跌21.4%。面对如此巨大的短期波动,我们认为维持整个行业的稳定发展非常重要。在未来的发展中,如何避免面板供需及价格过于剧烈波动,是面板产业链应该共同努力的方向。

群智咨询(Sigmaintell)预计2023年面板产值会有约5.5%的小幅增长。增长的主要驱动力一方面将来自Notebook和车载面板的增长需求;另一方面在面板厂商持续控产的前提下,预计2023年TV面板产值也将有小幅增加。

4. 大尺寸市场:“马太效应”重现,大者更大,强者恒强

2022年,从大尺寸面板市场(notebook、monitor和TV)来看,各面板厂商的策略和市场表现分化,头部厂商表现稳健,腰部厂商激进前行,中小面板厂商表现则低于预期,市场重现“马太效应”。

群智咨询(Sigmaintell)预测数据显示,全球大尺寸面板市场中,前五大面板厂出货量份额将从2020年的76%提升至2022年的81%。其中,中国大陆厂商京东方(BOE)的市场份额保持稳健增长、TCL华星(CSOT)在激进的产能扩增和市场策略推动下,市场份额呈积极增长态势;惠科(HKC)在TV应用领域的达到了稳居第三的水平,但作为面板的后来者,其在整个IT应用领域的竞争力相对薄弱,notebook领域出货同比下降,monitor增幅也受到需求下滑的抑制;中国台湾面板厂商在总体市场策略和产能投资方面相对保守,在整个大尺寸领域的规模优势正在逐步弱化,未来将走向产品的细分化或高端定位;韩厂则选择在LCD领域逐渐退出,在OLED领域逐步发力。LG显示(LGD)在TV应用面板出货中持续增加OLED占比;三星显示(SDC) OLED Notebook、monitor以及TV面板的出货未来也将呈现逐步增长态势。

5. OLED投资:面板厂将落地高世代OLED产线投资,并推动技术多元化

2022年,LCD面板产能转降,OLED面板产能保持增长。整体来看,OLED产线投资方向上将有较大转变,一方面是从低世代线向高世代线转移,另一方面是将呈现技术多元化的特点。

从全球的产能格局来看,中国面板厂商在LCD领域占据绝对竞争优势,产能占比超过70%。但是更多的要关注到OLED领域依然还是以双韩厂商为绝对主导。双韩厂商尤其是三星显示(SDC)在小尺寸领域保持领先优势,同时其对高世代面板产线,特别是G8.5代线的投资步伐也在加速,预计到2025年双韩厂商在OLED面板领域的整体占比依然还将维持在70%左右。虽然中国面板厂商也在积极赶超,但短期来看,与韩国厂商相比还有差距。

6. 高刷新率面板出货量将稳定增长;可折叠智能手机需求将保持较大增长

群智咨询(Sigmaintell)对全球消费者习惯的调研数据显示,高刷新率成为满足消费者娱乐属性、办公属性产品升级需求的重要方向,高刷新率的显示产品也在很大程度上提高了用户体验,加上全球面板厂商以及整机品牌厂商的积极布局,群智咨询(Sigmaintell)预计未来几年无论是在TV、monitor,还是在notebook领域,高刷新率产品都将迎来可期的增长。

小尺寸方面,智能手机进入存量市场,换机动力不足,但折叠手机正在成为新的增长驱动力。在全球主要手机品牌的积极布局和策略带动下,预计折叠手机的需求维持高速增长,根据群智咨询(Sigmaintell)预测数据,预计到2025年全球折叠手机的出货量将超过5000万台。

7. 面板厂商应降本增效,同时找准定位,提高御寒能力

在行业处于低谷的背景下,群智咨询(Sigmaintell)认为,一方面,面板厂商应积极推动成本和效率改善,尽可能降低运营成本。

从对于各面板厂商的获利情况的分析来看,中电熊猫(CEC-Panda)、LG显示(LGD)、友达(AUO)、群创(Innolux)、日本显示(JDI) 在2019年都遭受了巨额亏损,但在经历了2019年的下降周期之后,中国台湾面板厂商做了很多降本增效举措,包括产能和产品结构不断优化,目前中国台湾面板厂无论在成本方面,还是在技术和产品组合方面,都建立了相对竞争力。

另一方面,群智咨询(Sigmaintell)研究认为,具备较强抗周期波动风险能力的面板企业分为两大阵营,一类是做大做全,另一类则是做小做精。

大而全的代表是京东方(BOE)。京东方依托规模竞争优势及多品类协同发展优势,其整体获利能力和竞争力得到加强。即便其TV面板的出货面积在内部占比达到66%,但从营收来看,TV面板的营收占比只有25%,而手机、notebook和monitor等应用有均衡的份额。所以即使单一TV市场需求不佳,价值下滑,获利性不足,但仍可通过多品类之间的协同来抵御下滑。

小而精的代表之一则是三星显示(SDC)。三星显示主要聚焦OLED领域,得益于其深耕OLED领域的技术和产品竞争力其营业收入及利润率的表现都非常强劲。虽然今年其TV面板出货占比依然偏高,但是从营业收入的占比来看,TV面板的占比仅5%左右,其主要利润都是来自小尺寸OLED产品,在小尺寸OLED领域竞争力保持着绝对优势。

在目前整个面板行业寒冬下,各企业不应再靠单纯的价格竞争来提升份额,应结合自身情况,找准定位并构筑符合自身条件的竞争力,真正提升御寒能力。